Credit

What is a Good Credit Score?

What is a good credit score?

That’s probably the single most common question consumers ask, and the one most frequently asked of lenders and credit experts.

As much as we’d like to provide you with an absolute answer to that question, the reality is that it isn’t always clear.

Much depends on both the type of loan you’re applying for, as well as the specific lender. Though there are general guidelines as to what is a good credit score, each lender has its own standard. And it’s possible that you won’t qualify for approval, even if you meet a lender’s credit score guidelines.

As you’re about to learn, the information contained in your credit report can be just as important as your overall credit score. That’s why it’s important to know as much as possible about credit scores, and credit in general, before applying for a loan.

But with that said, we’re going to provide some general parameters on what is considered a good credit score.

Table of Contents:

- What is a Good Credit Score?

- Why It’s Important to Have a Good Credit Score.

- Your Credit Is More Than a Credit Score

- How To Get A Good Credit Score

What is a Good Credit Score?

Let’s go to the official source of FICO Scores, myFICO.com.

According to the information they provide, credit scores range between a low of 300 and a high at 850, though they can range from 250 to 900 for specific lending categories.

According to their information, credit score ranges are as follows:

| Credit Category | Credit Score Range | Likelihood of Delinquency |

|---|---|---|

| Exceptional | 800 or higher | 1% |

| Very Good | 740 to 799 | 2% |

| Good | 670 to 739 | 8% |

| Fair | 580 to 669 | 28% |

| Poor | 579 and lower | 61% |

Before looking for an answer to the question, what is a good credit score, the “official” answer would be 670 or higher.

But it’s important to understand that though 670 and above may be what myFICO determines to be a good credit score, interpretation of credit scores is highly subjective.

Each lender – in any specific loan category – will have its own guidelines as to what constitutes good credit.

For example, one lender may consider good credit to be 660 and above.

A second may determine 680 or higher, while a third may set the limit at 700.

An even more discerning lender may set the threshold at 720.

As much as we’d love to say there’s a specific credit score range that determines exactly what is considered a good credit score, there’s no definitive answer – at least not in all cases.

Get Your Free Credit Report Today

Why it’s Important to Have a Good Credit Score

Look at the table above, spending a few seconds scanning the “Likelihood of Delinquency” column. This is the whole reason credit categories and credit score ranges matter to lenders.

Likelihood of Delinquincy and Interest Rates

As you can see, credit scores of 800 or higher, known as an “Exceptional” have only a 1% likelihood of delinquency. That is why those who fit in this range are very likely to be approved for just about any type of loan they may apply for. And because the likelihood of delinquency is so low, they’ll also get the very best interest rates and terms.

But moving down to the “Very Good” category range, the delinquency rate only increases to 2%. People in this credit score range are also very likely to get any loan they apply for. And while they may not get the very best rates a lender has to offer, they’ll get something very close. And sometimes they’ll even get the best rates available, depending on the type of loan.

But moving to the third category, “Good,” notice that the delinquency rate increases to 8%. Though that’s still a reasonable rate, it’s not nearly as good as the Exceptional and Very Good categories, where the likelihood of delinquency is close to nonexistent.

This increased delinquency rate is the reason why someone with a credit score of 690 – while being highly likely to be approved for the credit requested – will pay a higher interest rate than someone with a score of 760 or 820.

And as you can see, the delinquency rate jumps dramatically in the “Fair” and “Poor” credit categories. Since high delinquency rates can easily turn into defaults, lenders will not only charge higher rates, but they’re also much more likely to decline credit applications for borrowers in these ranges.

Your Credit is More than a Credit Score

Most consumers naturally focus their attention on their credit scores. It’s become a convention because your score represents your credit profile in a single number. In addition, since it is a number, it’s measurable. If it rises, you’re headed in the right direction. But if it falls significantly, it can have an impact on your personal finances.

But while lenders may focus closely on credit scores, it’s not always the whole picture.

Credit scores are simply a numeric representation of your total credit profile. But lenders may also do a drill down into the details of your credit.

History of Bankruptcy

For example, let’s say your credit score is 690 and well within the range of credit scores accepted by a particular lender you want to make an application with. But if your credit report reveals you had bankruptcy five years ago, the lender may still decline your application. If the lender has a “no bankruptcy” policy, they won’t approve your application, even if you meet the credit score guidelines.

History of Late Payments

Other lenders may be even more specific. For example, if you had a 60-day late payment within the past two years, they may decline your application, even though your credit score meets the stated criteria. This can happen because lenders may establish criteria, such as no more than two 30-day late payments within the past two years. Because of the 60-day late payment, your application may not be approved even with what’s determined to be an acceptable credit score.

It’s not always possible to know what the secondary credit criteria is before applying for a loan. But it may be worth it to do some investigating before submitting a credit application, particularly if you have any of the above delinquency information showing in your credit report.

How to Get a Good Credit Score – Or at Least a Better One

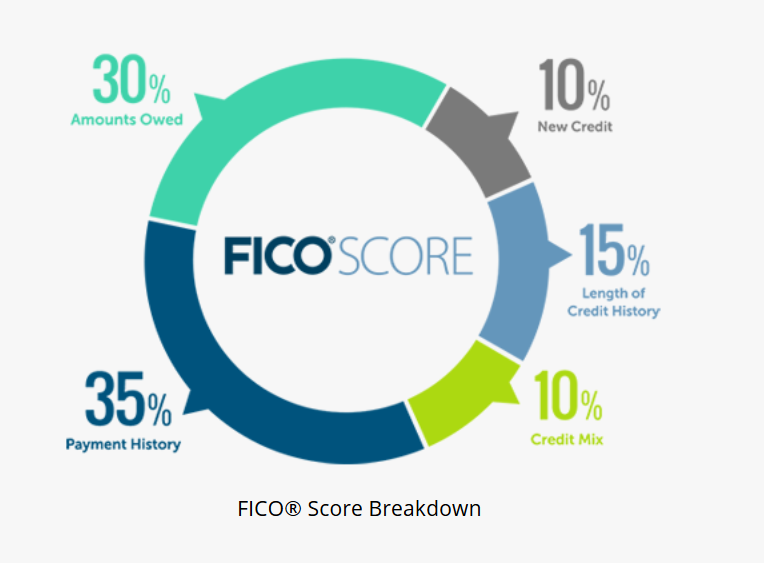

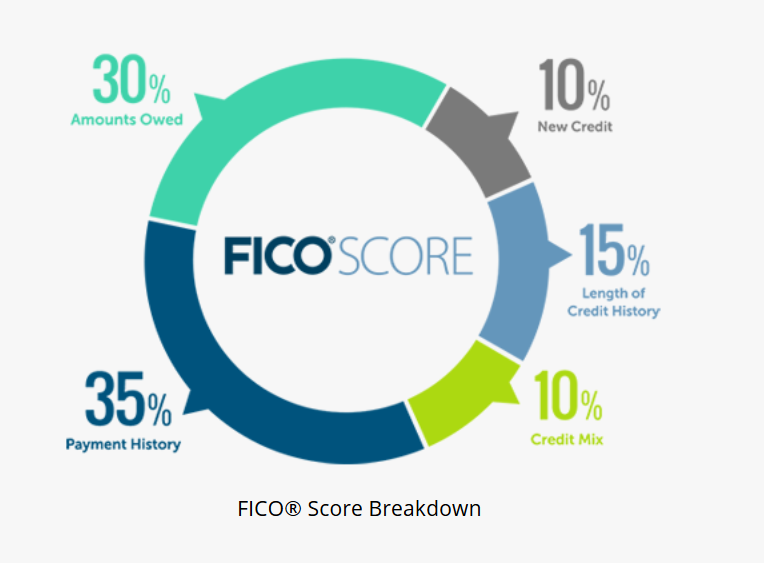

Once again, turning to the official source, according to myFICO.com, your credit score is calculated based on the following five factors.

Let’s discuss each of these factors individually, since each plays a part in determining your credit score.

Payment History

This the most important single factor, at 35%. The obvious best way to make this factor work in your favor is to make all of your payments on time.

If you do have a history of delinquent credit, take steps to improve it. First, get a copy of your credit report and look for any information that may be inaccurate so that you can dispute it with the creditors and, if necessary, directly with the credit bureaus.

If you have past due balances or collections, pay them off as soon as possible. Though the negative information will remain on your credit report, a paid past-due or collection is always better than an open, unpaid one. As well, once you pay it off, you’ll be on your way to having it gradually age-out of your credit score (older past-due and collection accounts have less impact than more recent and current ones).

Amounts Owed

This one is probably the most confusing for most consumers. Basically, it’s the amount you owe on loans and credit cards compared to either the high credit limit or the original loan balance. This is frequently referred to as the credit utilization ratio.

It’s generally recommended that you keep it at less than 30% to maintain good credit (for example, you owe less than $6,000 on credit limits and original loan balances of $20,000 or more). But excellent or exceptional credit is usually reserved for those with a ratio below 10%. At the opposite end of the spectrum, a credit utilization ratio of 80% or more is considered a predictor of future default.

To improve this ratio, pay down your loans and credit card balances while keeping each open and active. That will help you to improve your credit utilization ratio, and also your credit score.

Length of Credit History

Though only 15% of your credit score calculation, it can still be significant. Your credit score calculates the average age of all your credit accounts. The longer the average, the better your credit score. An average credit history over five years will fetch a higher score than one less than three years. But only time can improve this factor.

New Credit

New Credit is closely related to Length of Credit History. After all, new credit reduces the average age of your credit accounts. Too much new credit can hurt both the New Credit and Length of Credit History factors, which collectively constitute 25% of your credit score.

To get the upper hand in this category, apply for new credit only sparingly. For most consumers, that will probably mean no more than one or two new credit sources per year.

This is also the category where inquiries come into play. The credit scoring models consider inquiries to be a negative factor since they indicate you’re actively seeking new credit. And since new credit is a potential risk, inquiries can lower your credit score if only by a few points each.

Fortunately, inquiries age-out after only a few months. For that reason, be careful to apply for new credit no more than every few months – even if you don’t accept all the credit you’ve applied for.

Credit Mix

Fortunately, this factor accounts for only 10% of your credit score calculation. But if you’re trying to increase your credit score to the next credit category, it shouldn’t be ignored.

The credit scoring models give more favorable consideration to those with a mix of credit. The best scoring impact will be for those who have a mortgage, an auto loan, and several credit cards. It’s an indication that while you can responsibly manage multiple credit types, you’re not too heavily reliant on any one type.

At the opposite end of the spectrum, if your credit report shows five open credit lines, and all five are credit cards, this factor will work against you. It’s an indication you’re relying too heavily on a single credit type, and probably the riskiest one at that.

If your credit report shows too many of the same types of financing, mix it up with a different type. Having an auto loan alongside several credit cards is a solid mix.

So, What is a Good Credit Score?

Hopefully, you can appreciate why we recommend against generalizing about what is considered a good credit score. While there are definitely some loose guidelines that can give you a rough idea, the specifics are where it gets a bit fuzzy.

No matter what you read or believe to be the standard of good credit scores, always remember it depends on the rules set by each individual lender. Find out what those credit score guidelines are, as well as any component factors like major derogatory factors or significant delinquencies.

Armed with that information, you’ll dramatically increase the likelihood of being approved for whatever financing you apply for, and at the best possible rate. In between now and then, do whatever you need to do to move your credit score up to the next category. It can be the difference between paying a higher interest rate and a lower one, and sometimes between approval and denial of your application.

Unmasking Online Deception: An In-Depth Social Catfish Review

Purple Garden Psychics – ($1/Min) FREE Trial Offers, Real Experience & Benefits And More

Refinancing an Auto Loan: How to Know If It’s a Good Idea

Reverse Mortgages Pros and Cons: Ripoff or a Good Idea?

8 Ways it Just Got Easier to Achieve Student Loan Forgiveness

Unmasking Online Deception: An In-Depth Social Catfish Review

Orchard Bank Credit Cards | NOT a Scam!

PrivacyGuard Review

How to choose where to study as an international student