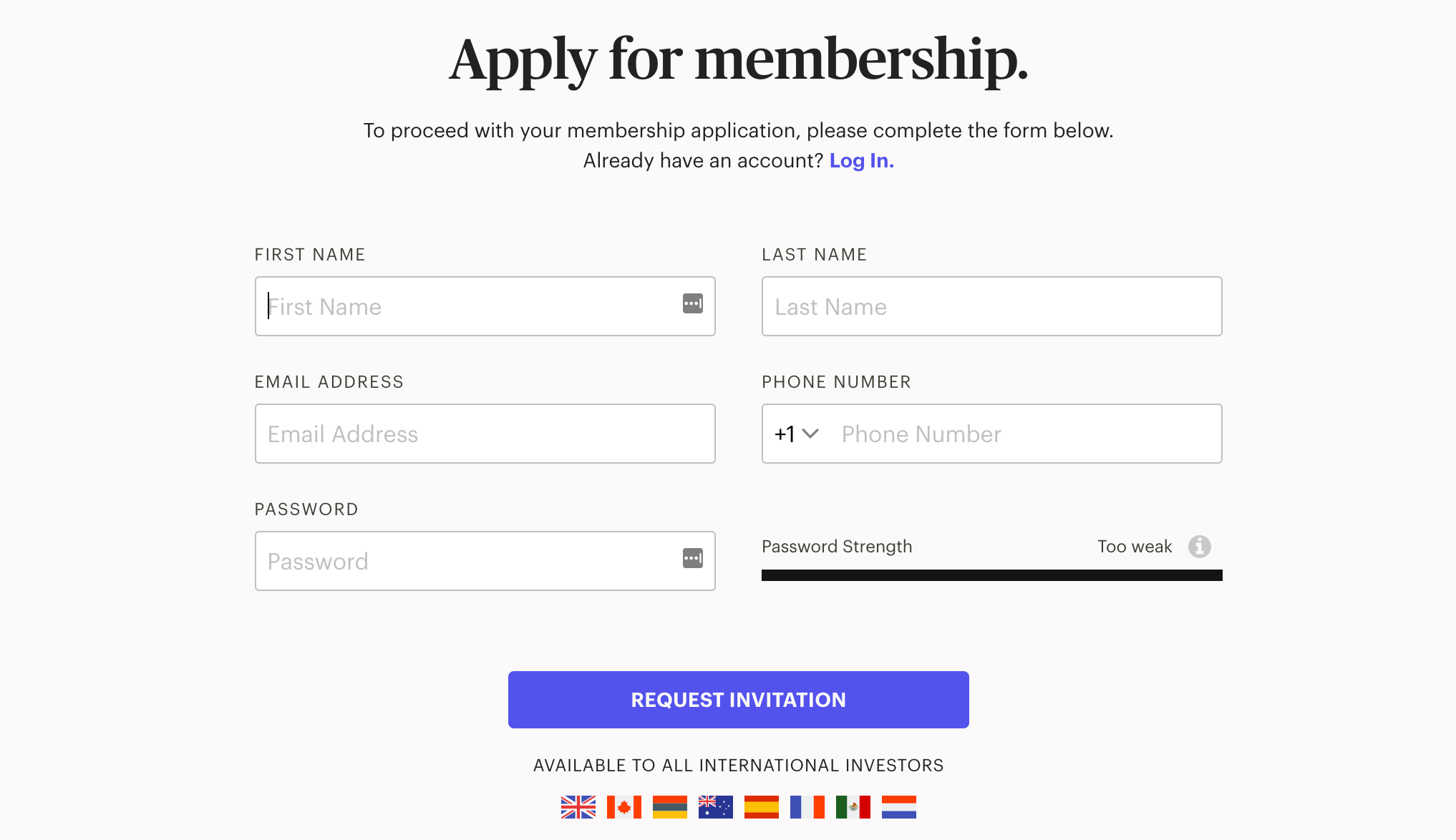

One of the best perks about Masterworks is that you do not have to be an accredited investor through the SEC (Securities and Exchange Commission) to get started. The only thing you’ll need is to apply a minimum investment of $1,000 (which can be spread across multiple works of art).

To begin the application process, you’ll have to request an invitation to

Masterworks (currently on waitlist).

Once you apply for membership, you’ll receive a number and need to complete a phone interview to finalize your membership. This interview is conducted primarily to verify your identity.

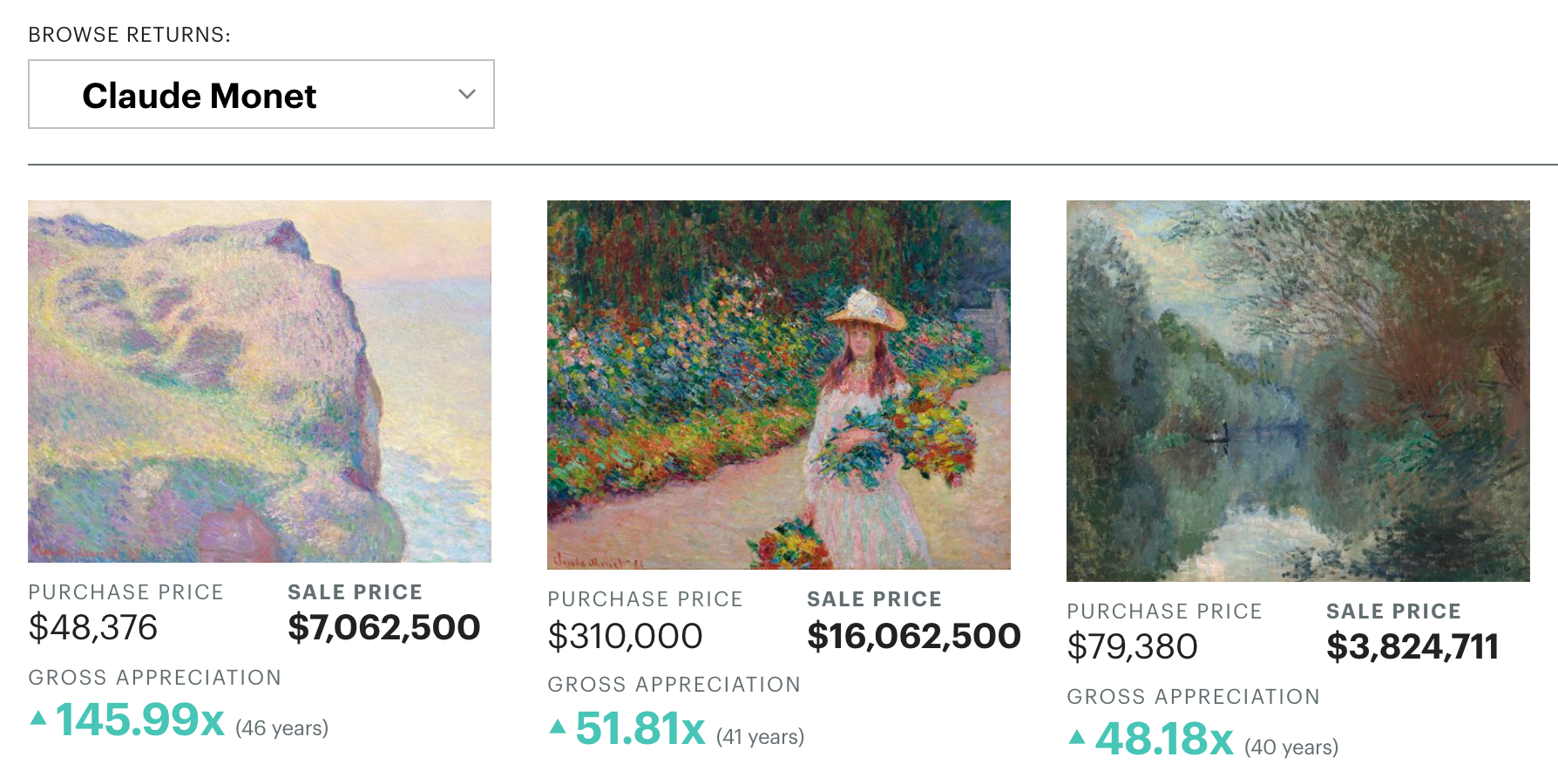

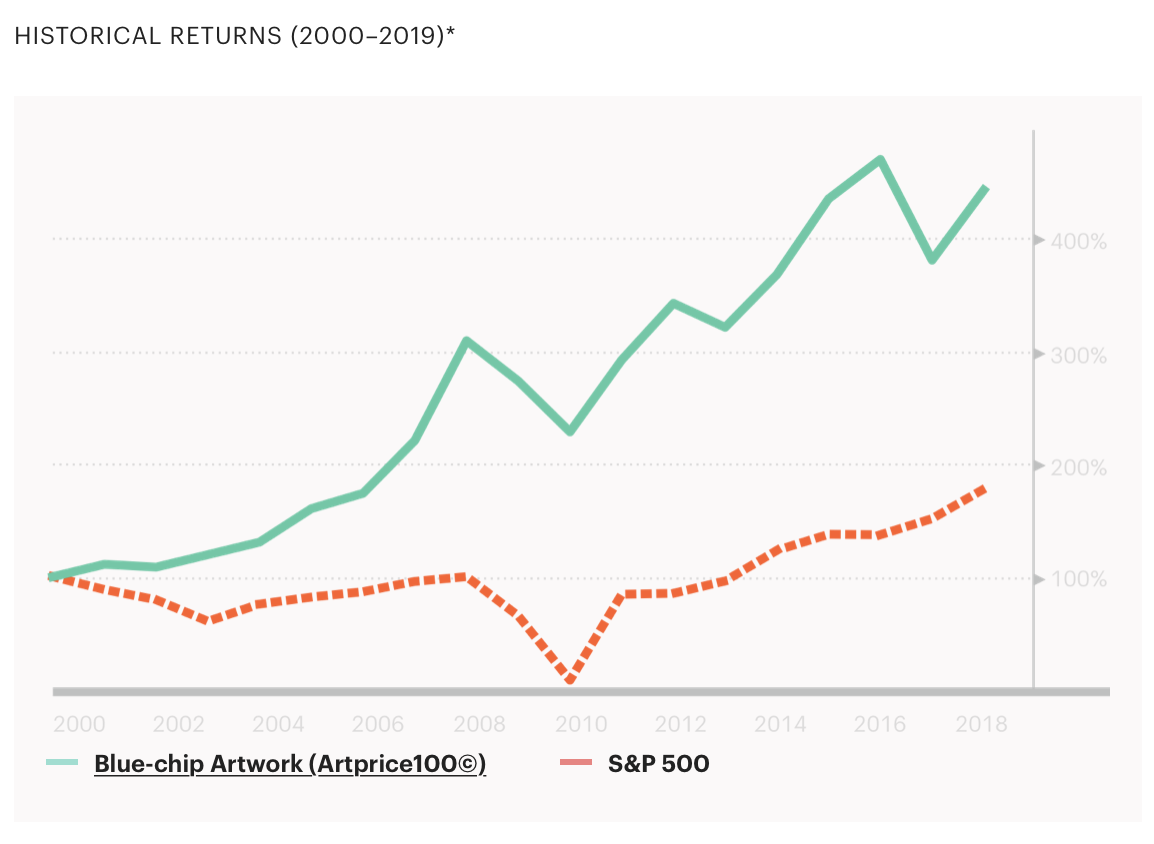

After you become a member, you’ll have access to invest in Masterworks’ art collection. The company’s business model uses an advanced algorithm to determine top artists and collections to invest in, with a proven record of appreciation. When the company purchases a work of art, they register it with the SEC and begin issuing shares. Shares can be purchased in increments of $20, but no single investor can own more than 10% of the shares of a single work of art. Investors then make money when Masterworks sells the art piece and divvies up the net proceeds.

- Masterworks purchases works of art from a list of artists determined by algorithms. It uses records from more than 1 million art auctions to pick top artists with proven histories of appreciation. Masterworks targets artworks where the artist demonstrates a historical 9% to 15% annual return.

- Once it purchases the art, Masterworks registers the art with the SEC and issues shares in $20 increments. No individual investor can hold more than 10% of the shares of any specific work.

- Masterworks holds the artwork and may even display it in the members-only gallery in New York City. It has a second office in Boulder, Colorado, but no gallery there.

- Masterworks plans to sell most of the artworks in around five to 10 years. Potential buyers make an offer that must be approved by a majority shareholder vote.

- When the art sells, the proceeds are divided among the pool of investors. Masterworks takes 20% of the profits as a fee.

- If you want to get out early, you can sell on Masterworks secondary market. Or you can buy shares of an artwork that is being sold on the secondary market, which you can view on their website.

- To research artists and investment prospects, members and the public can view a free database and blog on the Masterworks website.

How much does Masterworks cost?

Like all investment opportunities, it’s important to understand the fee structure before making a commitment. Masterworks fees are similar to investing with hedge funds.

Masterworks does not charge a signup fee but does require a minimum investment of $1,000. The platform also charges a 1.5% annual management fee for all members, which is used to cover transportation, storage, insurance, and administrative expenses. This can be paid with a debit or credit card.

When a painting appreciates and sells, Masterworks charges a 20% commission on any profit gained. While this percentage is admittedly high, it does indicate that Masterworks seeks to only buy a piece of artwork that is likely to appreciate, as they stand to gain a profit from each sale. Despite the slightly high commission percentage, Masterworks clearly stands by their process and is not in the market of ripping off investors — they only profit if you do.

Masterworks features

- Specific artwork selection. If you’re a lover of the arts or think traditional investing is a bit dry or uninspiring, Masterworks might offer a much more enjoyable experience. Not only can you invest in a wide selection of classic and highly regarded works of art — you also get to choose the specific artwork you invest in and can become a partial owner of a piece of art.

-

- Helpful art sales and research reports. Masterworks provides plenty of data on each selection of artwork, making it easier for you to invest in lucrative art pieces. The company provides auction sales report data for any art pieces that were sent to auction, as well as general global art reports recapping the current state of the art market and new art trends.

-

- Protected investments. Masterworks makes sure your investments are secure, safe, and well-preserved, to ensure maximum appreciation at the time of sale. Masterworks keeps all of their artwork in a temperature-controlled, museum-quality art gallery. Your 1.5% annual fee helps cover the cost of your artwork’s preservation and safe-keeping.

-

- Investor trading platform. Another key feature Masterworks provides is access to an investors trading platform, where you can buy or sell your shares using the company’s online bulletin board. If you aren’t prepared to wait for Masterworks to sell one of the pieces of art you own shares in, you can trade or sell using this method.

-

- Cutting-edge algorithms. It’s in the company’s best interests to ensure your artwork appreciates, which means Masterworks only searches for the top artists and works available through the marketplace. By analyzing buying patterns, new trends, and previous historical appreciation rates, Masterworks is able to bring high performing artwork right to your fingertips.