F Thimble Insurance Review 2022:

Founded in 2016, Thimble is a commercial insurance company covering approximately 130 industries. The company also operates under the name Verifly. Thimble offers general and professional liability coverage through Markel Insurance Company. The company is headquartered in New York City.

Thimble Commercial Insurance

Thimble is a relatively newcomer to the commercial insurance market. They offer flexible insurance coverage to 130 professional clients, offering both general and professional liability policies. The company differentiates itself by offering short-term coverage as short as an hour, but you can also buy coverage on a daily, weekly, or monthly basis. Customers can use their online quote tool to quickly understand the cost of Thimble coverage.

Thimble’s business targets small businesses and professional service providers, including sole proprietorships and consulting businesses. Whether you run a beauty salon, provide personal fitness training, clean your house, design a website, or run a handyman or landscaping business for a living, Thimble’s policy might suit your needs.

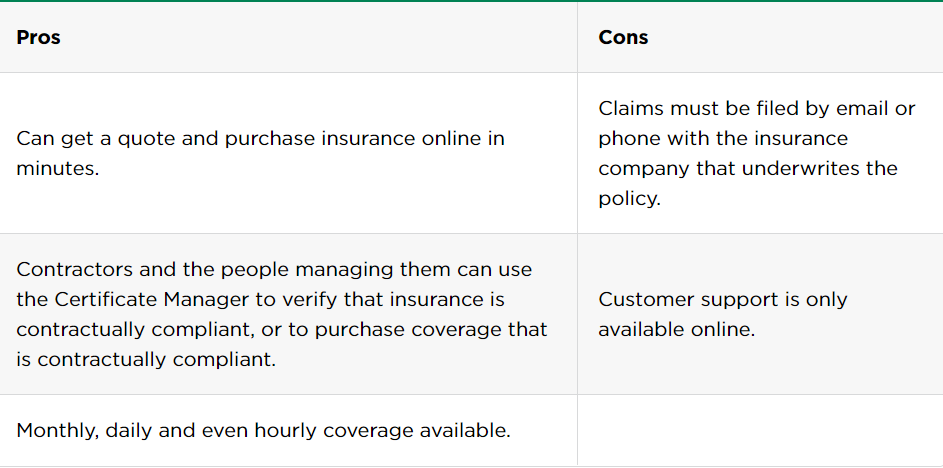

Thimble Insurance: Pros and Cons

Thimble Insurance Options

Thimble’s small business insurance options are relatively limited, but it covers the necessities of most self-employed professionals and contractors. Let’s take an in-depth look at the types of insurance it offers and how it structures its policies.

Type of Insurance

Thimble offers 3 types of insurance and is launching a 4th (more to come in the future).

General Liability Insurance

General liability insurance is essential for most types of businesses. It helps protect your business from losses due to:

Personal injury, when someone is injured on your business property.

Property damage, when your business damages someone else’s property.

Personal and advertising harm, when you promote something that damages another party’s reputation.

Thimble offers general liability coverage in 48 states and Washington, D.C. (Not available in New York or Washington.)

Professional Liability Insurance

Professional liability insurance will help cover claims if you make a mistake at work and cause your client to suffer financially. It helps pay for alleged or actual negligence, legal costs and settlements. This type of insurance is also known as errors and omissions insurance.

Thimble’s professional liability insurance is rolling out state by state. It is not yet available in New York, Washington, North Dakota, Wyoming, Colorado, Texas, Louisiana, Missouri, Iowa, Illinois, Indiana, Delaware, Rhode Island , Massachusetts and Vermont.

drone insurance

This coverage is another way Thimble differentiates itself. In fact, Thimble was formerly Verifly Drone Insurance, and you can still buy drone insurance through the Verifly app.

Drone insurance can help protect you if your drone flight causes any injury or property damage. It also provides protection against unintentional invasion of privacy and unintentional flight.

You enter where you plan to fly and choose whether you want a 1-hour, 4-hour or 8-hour policy. You can fly any drone that meets the policy weight limit, and you can choose up to $10 million in coverage. You can purchase a policy in just a few clicks and get proof of insurance instantly. You can purchase insurance up to 60 days in advance.

event insurance

Thimble has also introduced event insurance. This is a liability insurance for those who organize special events or attend events as suppliers or exhibitors. It includes coverage for 3rd party bodily injury and property damage, as well as coverage for legal fees and damages related to alcohol consumption at BYOB or open bar events. If you sell alcohol, you can add retail alcohol to your policy.

You can be notified as soon as you register on the Thimble website.

Override options

Commercial insurance is usually sold on an annual basis. While some insurance companies offer payment plans, this can still add up a lot of money, especially if you work seasonally or temporarily.

Thimble solves this problem by providing flexible options. you can choose:

Thimble Monthly: Thimble Monthly provides affordable ongoing coverage. You can cancel or suspend your coverage at any time.

Thimble On Demand: This option allows you to purchase coverage on an hourly, daily or weekly basis and you can cancel 1 hour before coverage begins. This comes in handy in many situations. For example, if you are bidding on a large project and need to show proof of insurance, you can purchase a Thimble On Demand policy. If the project fails, you can cancel.

Professional Thimble Cover

Thimbles cover more than 120 specialties across a range of industries. To see who Thimble is best for, here are the top 10 careers for its policyholders:

Pressure Washer

handyman

Landscaping

photographer

cleaners and cleaners

general contractor

videographer

carpenter

Fitness coach

construction worker

Thimble obviously covers a wide range of freelancers and consultants. It’s also a great choice for hair and grooming professionals, pet sitters, and drone pilots.

Thimble incident coverage includes incident liability coverage and alcohol liability coverage. The former pays legal fees and damages for bodily injury and property damage suffered by attendees, other vendors or venues. The latter includes legal fees and damages for drinking alcohol.

Insurance policies for a one-day event cost an average of $200, the company said, but prices can vary based on the number of attendees, whether alcohol is provided and other factors.

reputation

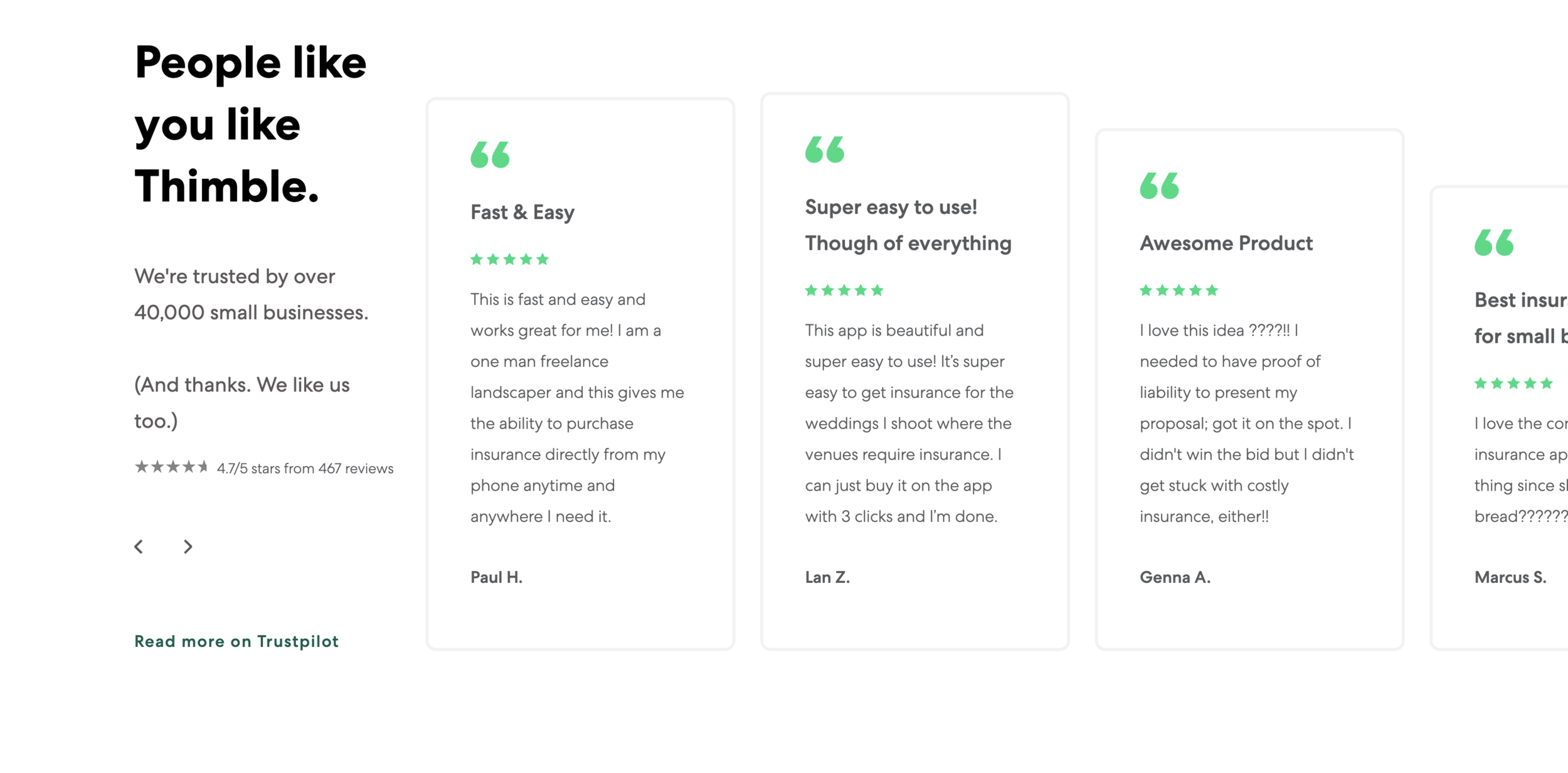

Thimble gets great reviews from customers on Trustpilot. It has over 621 reviews, 86% of which are 5-star reviews. Only four percent are one-star reviews. This means that customers are generally very satisfied with Thimble’s products and services. People especially notice how easy it is to get the policy and the service is good. The setback is related to the growing company’s policy restrictions.

concluding thoughts

If you wish to meet the insurance requirements of your business, you will need a quick and easy policy. You may also not need to buy insurance for an extended period of time, opting instead to buy a policy for the duration of a specific item. This is where the thimble shines. This is a good choice for general liability needs in the construction industry.

Learn more about thimbles

method

CommericalInsurance.net uses its own independent research to provide details of reviews. We do this so you can learn as much as possible about a company so you can make the best decisions for your business insurance. We took into account the company’s history and the places they serve. We want to highlight a company’s appetite because it shows where business owners can get the most competitive prices. Where possible, we include high-quality data. From there, we consider formal complaints, financial strength ratings, and public comments to paint a broad picture of a company’s reputation.

Unmasking Online Deception: An In-Depth Social Catfish Review

Purple Garden Psychics – ($1/Min) FREE Trial Offers, Real Experience & Benefits And More

Refinancing an Auto Loan: How to Know If It’s a Good Idea

Reverse Mortgages Pros and Cons: Ripoff or a Good Idea?

8 Ways it Just Got Easier to Achieve Student Loan Forgiveness

Unmasking Online Deception: An In-Depth Social Catfish Review

Orchard Bank Credit Cards | NOT a Scam!

PrivacyGuard Review

How to choose where to study as an international student