Guide to Tally: Consolidate card payments to beat credit card debt

Summary

App Tally offers a unique approach to debt consolidation – making your credit card payments for you to reduce your interest and save you money. While the service has potential, it may not be right for every kind of cardholder.

Do you regularly carry a credit card balance over 0% APR? Are you worried about paying on time and sometimes get hit with late fees?

If so, you may want to check out Tally. Tally saves you money and helps you pay down debt faster by consolidating your high-interest credit card balances, transferring them to a different line of credit at a lower interest rate.

It’s a lot like a credit card debt consolidation loan, but with extra features. It lets you pay one bill per month for all of your credit cards, while still making use of all your card rewards and benefits. You may even see a rather quick increase in your credit scores, because you’ll be transferring your credit card debt away.

Tally starts with the highest APR and works down from there. This strategy is known as the avalanche method, and it’s our favorite debt repayment plan.

If you’ve been struggling to pay off multiple credit card balances, Tally could help. According to Tally, the average user saves a total of $5,300. But there are several alternatives to consider. If you qualify for Tally, you’ll probably qualify for other debt repayment options as well.

Insider tip

We always recommend paying your credit card statement balances in full each month, unless you have a 0% rate. If you do that, Tally doesn’t have much to offer aside from its Late Fee Protection. But still, you could prevent late payments yourself by setting up autopay with your card issuer, in most cases, to ensure your payments arrive on time (although it’s possible for autopay to fail).

How does Tally work?

Here’s a simplified overview of the process (it’s a bit complicated):

- Download the app.

- Add the credit cards you want Tally to manage (you’ll need to provide usernames and passwords), and a checking account for payments.

- Tally looks at your credit card balances, APRs, and due dates.

- Tally checks your credit history and determines your eligibility for a Tally line of credit.

- Your Tally line of credit is used to consolidate any credit card balances with higher APRs.

- Tally automatically pays all of your credit cards on time each month.

- You repay Tally.

- Repeat steps 5 through 7 each month until you’re debt-free.

After registering, adding your credit cards, and providing your checking account info, Tally will check your credit with a soft inquiry to see if you’re eligible for a line of credit. Tally says that a FICO credit score of 660 or higher is typically required to qualify (see how to check your FICO scores here).

If approved, you’ll be granted a Tally line of credit from $2,000 to $20,000, at a variable APR of 7.9%–25.9% (current as of August 2020). This is a revolving credit line, like you get with a credit card, which can be used, paid off, and used again. That’s in contrast to a typical debt consolidation loan, where you get a lump sum and have to pay it back in monthly installments.

Your line of credit is then used to pay off any credit card balances with APRs higher than the APR of the line of credit. If you get a Tally line of credit at 10% APR, any credit card balance higher than 10% APR would be transferred over.

This saves you money because you’ll be charged less interest each month, and it can also improve your credit utilization (and your credit scores) because you’ll be reducing your credit card debt.

For any credit card balances with APRs lower than that of your Tally line of credit, only the minimum required payment will be made each month. That applies to cards with promotional 0% interest rates for purchases and balance transfers, too. You can use the “Promo Tracker” option to designate accounts with promotional APRs.

So, Tally pays your credit card bills. Then Tally sends you a bill for the total, and you only need to make that single payment each month. Your first payment to Tally will be due about a month after activating your account.

Be aware that it will take some time for your Tally account to get set up and working — at least a few business days. Don’t sign up for the service and expect your bills to be paid the same day.

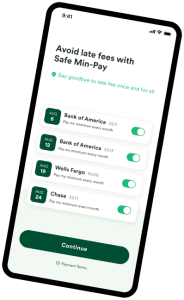

There’s one other feature to explain here: Late Fee Protection.

A few days before your due dates, Tally will check to see if the required minimum monthly payment has been made for each of your cards. If it hasn’t been made, Tally will make that minimum payment using your Tally credit line (even if your line of credit is fully utilized). That amount, plus any accrued interest, will have to be paid back by your next Tally due date. You can turn this feature on or off for individual cards.

That’s the basic idea, but there’s still more to know if you want to wield Tally effectively.

Tally Pays

Use the Tally Pays setting for any card that you can’t afford to pay in full.

If a card is set to Tally Pays (the default setting), Tally will pay the credit card bill each month using your Tally line of credit, at least two business days before the due date. Be sure to turn off autopay for any cards set to Tally Pays to avoid double payments.

You get one bill per month for all of the cards set to Tally Pays; Tally pays your bills, and you pay Tally. Payments to Tally are due by 5 p.m. PST on your due date.

Tally will tell you how much you should pay to become debt-free by your desired deadline, with one simple recommendation per month. You can set repayment goals, and the Tally Advisor will tell you how to stay on track.

The Tally Advisory tells you how much to pay to meet your repayment goals. Image credit: Tally

If you stop paying your Tally bill, Tally will stop paying your credit card bills. If you’re unable to make timely payments, you may be able to work out a repayment plan with Tally. Contact them at 866-50-TALLY or [email protected].

You Pay

If a card is set to You Pay, you’re responsible for paying off the credit card, just like normal.

You should use the You Pay setting for any cards that you plan to pay in full.

Tally will still remind you to pay a few days before the due date. You can pay through the Tally app, which will use your linked checking account; Tally will give an estimated payment arrival date. Or, you can pay directly to the card issuer as you typically would.

Be aware that if you pay through the app the payment could take at least four to six business days to arrive, so it’ll probably be faster to pay the issuer directly.

When using You Pay, Tally recommends disabling Late Fee Protection to avoid double payments unless your payments will be made seven business days or more prior to the due date. If Late Fee Protection is on and it’s getting close to the due date, and Tally detects that your bill hasn’t yet been paid, Tally will automatically make the minimum payment so you’re not late. And then your own payment would go through, resulting in overpayment.

So pay early, or turn off Late Fee Protection for cards set to You Pay.

For Tally to work as intended, you must keep all your personal, credit card, and bank account information up to date in the app. If anything changes, update your Tally profile as soon as possible. This includes:

- Email and mailing address

- Phone number

- Credit card numbers, account usernames, and account passwords

- Checking account and bank routing numbers

HOW TO QUALIFY FOR A TALLY CREDIT LINE

Tally will look at the following info to determine if you’re eligible for a line of credit:

Tally will look at the following info to determine if you’re eligible for a line of credit:

- Credit score: You’ll need a minimum score of 660 for Tally Basic or 580 for Tally+.

- Credit history

- Employment status

- Property status

Tally does not have a minimum income requirement.

PROS

Tally Does the Number Crunching for You

Tally will look at each card balance to figure out the optimal payment amount to make on each and which one to pay off first.

Save Money With A Lower APR

When you qualify, you can transfer any credit card balances to a Tally credit line. Assuming the APR is lower, that means you’ll save on interest charges to pay off your debt faster.

No Overlimit Fees

If you use your entire Tally credit line, Tally will still pay your credit cards’ minimum payments without charging additional fees.

In exchange, they require you to pay the amount they paid back plus interest by your next Tally credit line due date.

Secure System

Tally uses SSL encryption and doesn’t store your usernames or passwords. They also never sell or share your personal information without your approval.

Late Fee Protection

If your credit line is in good standing, Tally will check all credit cards before their due date to make sure the minimum payments have been made.

If you didn’t make a payment, Tally uses funds from your credit line to make the minimum payment. If you prefer not to have this protection, you can cancel it in your preferences.

Tally FAQs

How much does Tally cost?

Tally has no origination fee, annual fee, transfer fees, or late fees. But that doesn’t mean it’s completely free to use.

Your Tally line of credit will come with an interest rate; the bigger the balance, the bigger your interest charges will be. However, you should save money overall because you’ll transfer credit card balances with higher APRs over to your Tally line of credit. Since you’re carrying the debt at a lower APR, your interest charges will be lower — saving you money.

Although Tally isn’t a 100% free-to-use service, it should be effectively free to use — compared to carrying the debt at a higher interest rate.

Tally makes money from the interest charged on the Tally line of credit. But it only makes money if it can save you money, by letting you carry a balance at a lower rate.

Is Tally worth it?

Tally could be worth it if you fall into either of these camps (or both):

- You tend to carry a credit card balance from month to month at an interest rate greater than 0%.

- You’re worried about late credit card payments.

Although we recommend never carrying a credit card balance above 0% APR, if you do have to carry a balance Tally may help by reducing your interest charges.

Or, if you’re concerned about missing a credit card payment, Tally’s Late Fee Protection feature could come in handy. (Thinking about how to pay your credit card bills? Learn all about how paying a credit card works.)

Is Tally safe?

The threat of online hacking is pervasive, but Tally is as safe as many other banking, credit card, and finance websites. Tally uses SSL encryption and 256-bit encryption to transmit your data, and it doesn’t store your bank usernames and passwords.

Submitting account usernames and passwords could (understandably) make some people nervous. But Tally needs to check your credit card balances, APRs, and due dates, so it has a legit need for this information.

What credit cards work with Tally?

Credit cards from most of the major card issuers will work with Tally, but not all issuers are currently eligible. The list of eligible issuers includes:

- American Express

- Bank of America

- Capital One

- Chase

- Citi

- Discover

- U.S. Bank

You can see a full list of the issuers Tally supports, along with a separate list of co-branded store cards that work with Tally. Those lists are slated to expand, so check back later if your card isn’t included now.

Who can use Tally?

You must be at least 18 and a resident of an eligible state to use Tally. If Tally isn’t yet available in your state, you can sign up for the waitlist and get notified when it’s available.

As of August 2020, Tally is available in Arizona, Arkansas, California, Colorado, Connecticut, Washington DC, Florida, Georgia, Illinois, Idaho, Iowa, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Missouri, New Mexico, New Jersey, New York, Ohio, Oregon, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Washington, and Wisconsin.

Should You Use Tally?

If you fit one of the two categories discussed above (you carry card balances over 0%, or you’re worried about late payments), Tally is definitely worth considering.

- It should help you save money if you’re carrying credit card debt over 0% APR.

- It pays down your debt with the avalanche method, an effective debt reduction strategy.

- It ends up being effectively free to use.

- It can boost your credit scores quickly.

- You can pay just one bill per month for all your credit cards.

- It can automatically make your minimum payment if you forget.

If you use Tally, stop using your high-interest credit cards! Don’t rack up more high-interest debt just to transfer it to a lower rate each month.