Credit

What Is Credit Repair and How It Works

We normally associate credit repair with people who have bad credit. But almost everyone will need some credit repair help at some point in life.

Yes, credit repair is a bigger deal for people with lower credit scores, but even consumers with good credit scores can get better offers from lenders by improving their credit files.

For example, a home buyer with a FICO score of 780 will have multiple mortgage options while someone with a FICO score of 580 may qualify for only one type of home loan.

When you have multiple lenders hoping to sell you a loan, you’re likely to save thousands of dollars in interest charges and borrow larger amounts.

If you need to upgrade your credit report, keep reading.

You may need negative information removed from your credit history. You may need to rearrange your debts to get your credit score higher. Or you may just need to start making on-time payments to build positive credit momentum.

All of these strategies, and a few more, qualify as credit repair.

Table of Contents:

- What is Credit Repair

- Credit Repair Companies

- Credit Repair Software

- DIY Credit Repair

- Credit Repair Takes Time

- Credit Repair Infographic

What is Credit Repair?

When you’re ready to increase your credit score so you can get lower interest rates on your loans, you’ll need to take actions that fall within two broad categories:

- Deleting or minimizing negative information that’s now appearing in your credit reports.

- Adding new positive entries on your credit reports by developing strong credit habits and making sound decisions.

Let’s look closely at each strategy because you’ll likely need to use both:

Eliminating or Minimizing Negative Credit Information

Negative items pull down your credit score. To remove negative information, you must start by identifying it.

This process starts at annualcreditreport.com where you can download free credit reports. You should get three reports — one each from Experian, TransUnion, and Equifax, the three major credit bureaus.

Once you have a copy of your most recent free credit reports, examine each line of each report. When you see negative information, circle or highlight it — or take notes you can refer back to later.

Negative information includes late payments, missed payments, hard inquiries, bankruptcies, and repossessions.

LOOK FOR CREDIT REPORTING ERRORS AND DISPUTE THEM

Look back at the negative information you found in your reports. Is all of it accurate information?

If not, you’ll have an easier time deleting this information because the Fair Credit Reporting Act requires credit reporting agencies to report only accurate information.

Incorrect information could include collections accounts that are not yours, accounts with negative payment histories that belong to someone else such as an ex-spouse, or open balances you’ve long since paid off.

By getting this incorrect information fixed, or removed from your report entirely, your credit score will get an instant boost.

Check out my post about writing dispute letters to get started.

MINIMIZE THE DAMAGE FROM NEGATIVE INFORMATION

Once you’ve disputed the inaccuracies pulling down your credit score, you’ll also want to address the accurate information that’s impacting your score.

You shouldn’t dispute accurate information but you do have some options for removing it:

- Write Goodwill Letters: When you’ve paid off a balance but it still remains on your credit report, you can ask the debt collector to remove its negative information as an act of goodwill. See my post about goodwill letters here.

- Make Pay-for-Delete Agreements: When you haven’t paid off a debt collector yet, you may be able to use your remaining balance as leverage. You could agree (in a written contract) to pay the bill (or part of it) in exchange for getting the negative item removed from your credit history. You can find some details about a pay-for-delete agreement here.

These are the two main ways to remove negative items from your own credit.

You could also hire a professional to do this work for you. I recommend Credit Saint and Lexington Law. These credit repair services aren’t scams. They’ll do the heavy lifting for you while also protecting your legal rights as a consumer.

Increasing Positive Credit Entries

Along with removing negative information that presents red flags to potential lenders, you should also add new positive credit data that will tell lenders you’re a reliable borrower.

This is especially true for younger people just starting out building a credit file.

If you already have good credit, you’ll naturally want to continue making your payments on time and following these other guidelines so you can protect your good credit history.

MANAGE YOUR CREDIT UTILIZATION

Excessive credit utilization is one of the biggest potential negatives that you can avoid by taking one action: paying down your credit card balances and keeping them paid down.

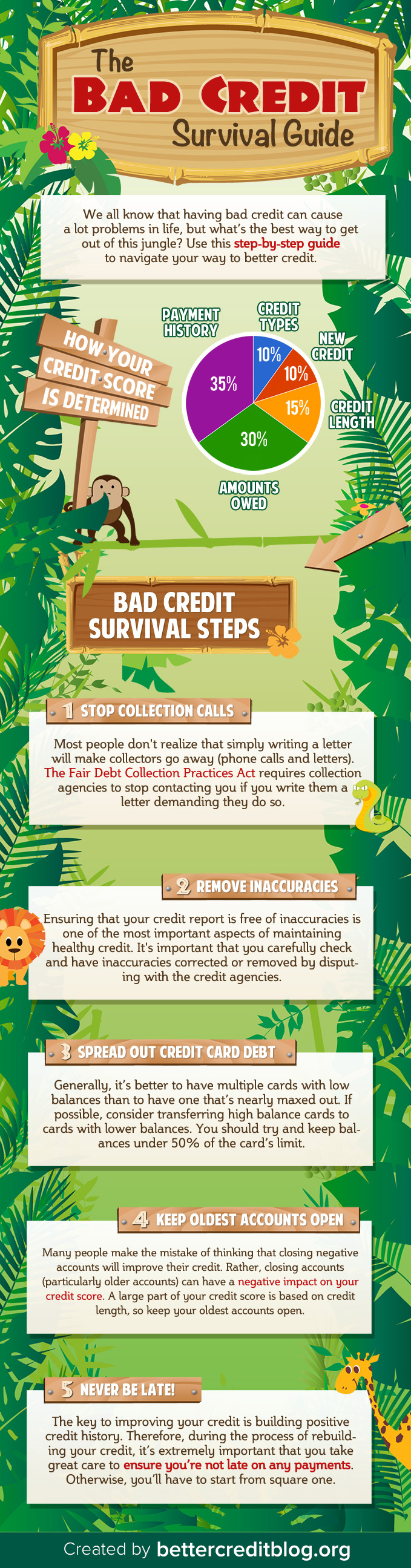

Almost a third of your FICO credit score comes from your credit utilization ratio. This ratio is the amount of money you owe on revolving credit divided by your total credit limits.

For example, let’s say you have five credit cards with a combined credit limit of $20,000. If you owe a total of $15,000 across the five cards, your credit utilization ratio is 75% ($15,000 divided by $20,000).

A credit utilization ratio of 75% is excessive, and this will weigh down your credit rating.

A credit utilization ratio of 80% tells lenders you’re a risk for defaulting since you’re nearly maxing out your cards.

The lower the rate is, the better. But a ratio below 30% is considered ideal. If you have a good credit score, and you’re looking to improve it, getting the ratio below 30% may be the most important strategy.

Pro tip: Keep a credit card account open even after you’ve paid it off to help minimize your credit utilization ratio. Do not continue using the paid-off account.

MAKE YOUR PAYMENT HISTORY SHINE

Credit utilization matters a lot but your payment history matters even more. By making on-time payments on all your loans and credit cards, you’re building a good credit score, brick by brick.

Payment history comprises 35% of your FICO score. So missing a single payment on your student loan or credit card and your score will suffer.

Miss several payments in a short period of time and you’ll have a poor credit score within months.

If you can’t afford your payments, look into a debt consolidation loan before you miss payments and get poor credit since a lower credit score limits your loan options.

USE SPECIAL CREDIT BUILDING LOANS IF NECCESARY

People repairing their credit often come across this Catch-22. You need a solid payment history to improve your credit, but you can’t make payments unless you get approved for new credit, right?

Well, this is a big problem for people, but I know two good ways to spring this trap without having to bother anybody about co-signing on your loan or credit card:

- Secured credit cards: With secured credit cards you pay the card issuer a deposit to secure your own credit limit. No, you won’t really be borrowing money, but you will be adding positive data to your payment history by making the payments on time.

- Credit builder loans: These loans work like secured credit cards except they’re even easier to use. Ask your bank or credit union if they offer credit builder loans. All your “borrowed” money from the loan will go into a special savings account to fund your regular on-time payments. This can get the ball rolling toward good credit.

Make sure your card issuer or lending bank reports your payment history to the three credit bureaus before getting one of these financial products. Reporting your payment history is the whole point.

If you build a positive payment history you should start seeing an increase in your credit score within a few months.

PAY OFF EXISTING LOANS

One of the best ways to increase your score is by paying off a loan or a credit card.

We’ve already discussed the importance of credit utilization ratio, and paying off credit cards improves this ratio.

But paying off a credit card or an installment loan completely, you’ll boost your credit score by at least a few points immediately.

The credit bureaus like paid loans because they confirm you’ve successfully completed your credit obligations. The more paid-off loans you have, the better.

This isn’t to say that you need to pay off all your loans. But your credit report should reflect a healthy mix of both open and paid loans.

You could do this by taking small loans, making the payments on time, and paying them off early.

LIMIT NEW CREDIT APPLICATIONS

When you saw a copy of your credit reports you may have noticed a section dedicated to credit inquiries.

Each time you apply for a credit card or loan, the lender will check your credit score. These checks can, over time, lower your credit score.

So apply for new loans only when you have to — and only if you think you have a good chance for approval.

Soft credit inquiries will appear when you check your own credit score or when you get pre-approved for a loan. These soft inquiries will not hurt your credit score.

Credit Repair Companies

Everything in this post, so far, has explained ways you can build new credit and improve existing credit by deleting negative items from your credit history.

You can do all this work by yourself, and this blog is dedicated, in part, to exploring how to fix and build your own credit.

But credit repair services exist for a reason. They offer a professional service: repairing your credit for you.

Who Needs Professional Credit Repair Services?

If one or two negative items are pulling down your credit score, you should seriously consider repairing your own credit because paying a pro would not be cost-effective.

If you have an average or good credit score, and you’re just looking to improve it over time, follow the guidelines above and don’t hire a pro.

But if you have fair or poor credit, caused by multiple negative credit entries that seem to be overlapping and feeding off each other, consider hiring a credit repair company.

A credit repair service has a staff dedicated to sending dispute letters and making phone calls on your behalf.

Someone who doesn’t have hours to spend each day on the phone can benefit from paying a pro to do this work instead. You’d probably spend at least $400 to $600 over a few months.

Finding a Good Credit Repair Company

A good credit repair company is staffed by experienced, competent professionals who know their way around the credit universe.

They’re well acquainted with disputing negative information and negotiating with creditors – even the uncooperative ones.

You’ll pay a fee for a professional credit repair service — both an upfront set-up fee and an ongoing monthly payment — but this expense may be well worth paying if your credit report shows a lot of negative entries.

If you have one or more particularly difficult credit situations on your report, you should lean toward a credit repair company that’s also a law firm (which many are). Often, just getting an attorney involved in your situation is enough to make the ornery creditor cooperate.

Finding the Right Credit Repair Company

You’ll need to be careful in selecting a reputable credit repair company. The industry has grown large in recent years, and it’s filled with companies that have little or no real experience.

Unfortunately, you’ll come across credit repair scams, too. So make sure the company you choose follows the Credit Repair Organizations Act. Ask about the CROA during your free consultation to make sure.

Be wary of a company that makes promises because nothing can be guaranteed in credit repair. Most reputable companies do offer money-back guarantees, but this isn’t the same as guaranteeing a dramatic increase in your credit score.

We keep a list of 10 credit repair companies you can check out to begin the search for one that will work for you.

Ads by Money. We may be compensated when you click on this ad.

Ad

Find Locally Licensed Experts Select your state to get started Hawaii Alaska Florida South Carolina Georgia Alabama North Carolina Tennessee RI Rhode Island CT Connecticut MA Massachusetts Maine NH New Hampshire VT Vermont New York NJ New Jersey DE Delaware MD Maryland West Virginia Ohio Michigan Arizona Nevada Utah Colorado New Mexico South Dakota Iowa Indiana Illinois Minnesota Wisconsin Missouri Louisiana Virginia DC Washington DC Idaho California North Dakota Washington Oregon Montana Wyoming Nebraska Kansas Oklahoma Pennsylvania Kentucky Mississippi Arkansas Texas Contact an Expert

Find Locally Licensed Experts Select your state to get started Hawaii Alaska Florida South Carolina Georgia Alabama North Carolina Tennessee RI Rhode Island CT Connecticut MA Massachusetts Maine NH New Hampshire VT Vermont New York NJ New Jersey DE Delaware MD Maryland West Virginia Ohio Michigan Arizona Nevada Utah Colorado New Mexico South Dakota Iowa Indiana Illinois Minnesota Wisconsin Missouri Louisiana Virginia DC Washington DC Idaho California North Dakota Washington Oregon Montana Wyoming Nebraska Kansas Oklahoma Pennsylvania Kentucky Mississippi Arkansas Texas Contact an Expert

Credit Repair Software

Credit repair software is an area of credit repair that we usually discourage readers from using.

Software has become a big part of the growing credit repair industry, but it doesn’t offer the value of a professional credit repair company.

Instead, it gives you a set of tools to use in your own credit repair journey. You’ll still be doing the work yourself, but the software can help you stay organized. It can also help you write and format dispute letters.

With software, you’ll be charged a fee that can range anywhere from $50 to as much is $400.

There are three problems with credit repair software you need to be aware of:

- As discussed above, you’ll pay a fee for the product.

- They only provide forms, which means you’ll be doing all the work.

- In most cases, there’s nothing they provide that you can’t get elsewhere on the web for free.

Yes, a lot of products and services are now available on the web. But that doesn’t mean they’re all worth paying for.

Credit repair software falls into this category. Simply having forms won’t fix your credit problems, nor will it save you the time needed to get the job done.

Do-It-Yourself (DIY) Credit Repair

DIY credit repair is always an option as long as you feel up to the task. For a consumer with only a couple credit blemishes, DIY is the way to go.

But if you have more elaborate problems, the DIY approach will work better if you have some experience successfully disputing credit information in the past. You’ll also need to be comfortable having awkward conversations on the phone.

I won’t get bogged down in the details here; the first half of this post already focuses on this approach.

But here are some additional guidelines if you’re starting a DIY credit repair project:

Know your rights under the law

The Fair Debt Collection Practices Act is a federal law that limits what creditors can do to collect debts, and is administered by the Federal Trade Commission (FTC).

For example, this law limits when a collection agency or debt collector can call you, and it prohibits them from making threats.

Just knowing your consumer protections under this law can go a long way toward taming a hostile creditor.

Get a copy of your latest credit report

It’s best to have one report from each of the three bureaus, TransUnion, Equifax and Experian. Information can appear on one that isn’t on the others. Review each report, and highlight any negative entries.

Like I said above, get your free credit reports from annualcreditreport.com.

Look for errors

Many credit reports contain errors, usually of the negative variety. If you find errors, you’ll need to contact the three credit bureaus and open a dispute.

The credit bureaus will investigate the entry, and if it’s not yours, they’re required to remove it by law (Fair Credit Reporting Act).

Sometimes you may need to dispute an item directly with the creditor. If you do, you’ll need to write a cover letter that summarizes the dispute, and attach any supporting documentation.

But be warned that if you don’t have any documentation to support your claim, the creditor may not remove the item.

Contrary to what you may have heard or read, it’s generally not possible to get negative credit information removed without hard evidence.

Credit Monitoring Is a Must

By monitoring your credit you can prevent ever needing a major credit repair project.

You’ll notice problems — including identity theft and inaccurate information — before they destroy your credit score.

Free or paid credit monitoring services can help. Free services tend to offer the basics while a paid service can help rebuild your credit after identity theft or some other major problem wrecks it.

See our list of the best credit monitoring services here.

Credit Counseling Could Help

Nonprofit and for-profit credit counseling services can help you better understand your credit problems and come up with solutions.

Just make sure you stay in control of the process. Do not agree to your credit counselor’s new debt management plan unless you’re comfortable with it and you understand what’s required of you.

Time Heals All Credit Wounds – Eventually

You may have negative information that neither you nor a professional could remove from your credit history.

This could include public records like bankruptcies and derogatory credit information that’s reported accurately. Even if this is true, all isn’t lost.

The one advantage you have working in your favor with credit problems is time. The more time passes between the negative credit event and today, the less impact it will have on your credit score.

For example, a late payment from five years ago has less impact than one from six months ago. Eventually, all the negative information will fall off your credit report in its own time. This should happen within seven years and 10 years, depending on the type of derogatory information.

Do what you can to remove as much negative information from your credit report as possible. If your credit history shows a past-due balance or a collection account you owe, pay it or negotiate with the debt collector immediately.

And, as described earlier, pay all your debts on time from now on, and systematically work to add new, positive credit to your report. As your positive credit builds, and time passes, the negative stuff will eventually go away.

When the negative information ages off and you have only positive information building your score, you’ll have excellent credit.

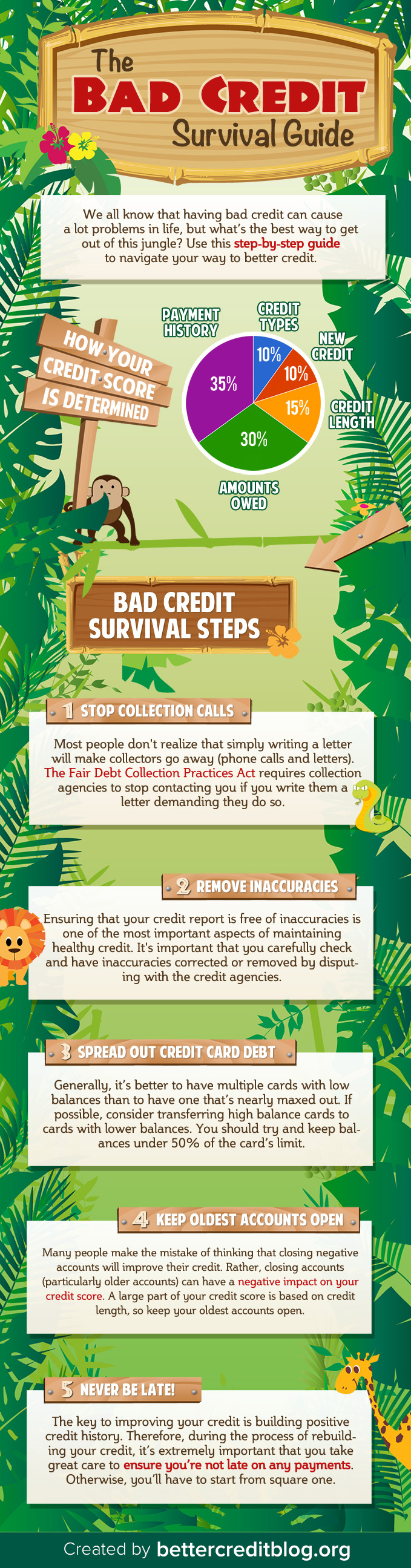

A Guide to Repairing Your Credit

We’ve summed up our best credit repair strategies into an infographic. Here’s our bad credit survival guide:

In this article, we’ve presented a high-altitude view of the credit repair process.

It can be fairly simple if you only have a little bit of bad credit, or you’re just looking to improve your score. But it can be amazingly complicated if you have a long history of bad credit.

That’s when you need to call in the professionals, like credit repair companies, and avoid making any more mistakes to hurt your credit any further.

But check back with us on a regular basis. We’ll be expanding on each of these topics going forward.

If you have thoughts of going the DIY route to credit repair, you won’t want to miss any of them.

Unmasking Online Deception: An In-Depth Social Catfish Review

Purple Garden Psychics – ($1/Min) FREE Trial Offers, Real Experience & Benefits And More

Refinancing an Auto Loan: How to Know If It’s a Good Idea

Reverse Mortgages Pros and Cons: Ripoff or a Good Idea?

8 Ways it Just Got Easier to Achieve Student Loan Forgiveness

Unmasking Online Deception: An In-Depth Social Catfish Review

Orchard Bank Credit Cards | NOT a Scam!

PrivacyGuard Review

How to choose where to study as an international student