FreshBooks Review 2022: Is it worth trying?

What is FreshBooks?

FreshBooks frees the bill from your hands and puts it in a self-driving state. Set up automatic invoicing, online payment options (ACH and credit cards), and late payment reminders to get paid twice as fast. Next, improve team productivity through precise time tracking and collaborative project tools to track and record every minute, file, and conversation. FreshBooks is a web-based accounting solution for small businesses. FreshBooks serves multiple industries, such as marketing, legal services and business consulting, trade and household services, and information technology (IT). The main functions of FreshBooks include invoicing, expense tracking, time tracking, reporting, and payment management. Users can brand their invoices, accept online payments and set automatic payment reminders. You can track expenses by attaching receipts to invoices, create recurring expenses, and take snapshots of receipts. Financial status can be viewed through the income statement, tax summary and expense report. FreshBooks categorizes credit card transaction fees and provides a summary of all deposits on its dashboard. The time tracking module of the system can extract the unbilled project working hours into the invoice, record the billable time and provide an analysis of the time spent on the project. FreshBooks can also integrate with Paypal, MailChimp, Zenpayroll and Basecamp. The time tracking module can extract the unbilled project working hours into the invoice, record the billable time and provide an analysis of the time spent on the project. FreshBooks can also integrate with Paypal, MailChimp, Zenpayroll and Basecamp. The time tracking module can extract the unbilled project working hours into the invoice, record the billable time and provide an analysis of the time spent on the project. FreshBooks can also integrate with Paypal, MailChimp, Zenpayroll and Basecamp.

How does FreshBooks work?

You can try FreshBooks for free for 30 days without a credit card. All you need to do is register with your email and new password.

Once your email is confirmed, you will be able to access your FreshBooks dashboard, where you can start to organize your company profile and list all your services and products (this is what you will use to fill in invoices, proposals, estimates And project information quickly).

After putting your business information together, you need to set up your bank connection (done through Yodlee) so that you can start importing transactions.

After setting up the bank connection, you can use the WePay system to accept credit card payments through the FreshBooks platform. Your account must be verified, so be sure to check your email.

If you have international customers, you can also set up to accept payments through Stripe.

From there you can add team members and start creating invoices and use different functions.

Pros And Cons

–Benefits of FreshBooks

Well-rated customer support, available via phone and email

FreshBooks stands out from other accounting products, and its customer support services are highly rated on multiple online review sites. E-mails are usually answered within 90 minutes, and the customer support representative will answer the call within three rings. Customer support is available from 8 am to 8 pm Eastern time on weekdays.

–Good invoice service

The invoicing feature suite of all FreshBooks plans also differentiates it from competitors. You can choose from a variety of customizable designs, set up regular digital invoices, easily include discounts, and get instant updates when you view or pay invoices online. All these functions are also available on the mobile app. QuickBooks Online does not provide so many invoice customization options. Although Xero offers customizable invoices, it limits the number of invoices you can send on its cheaper tier.

–All plans include time tracking and mileage tracking

All FreshBooks plans include mileage tracking and time tracking features, which are also built into the mobile app. These features are very useful when you run a small business and don’t want to buy a separate add-on, or when you’re an out-of-town entrepreneur. QuickBooks Online only provides time tracking in the Essentials plan and above. Xero users track mileage and time through Xero Expenses, which is only included in the highest level of established plans.

Frequently asked questions

–Does FreshBooks provide payroll services?

FreshBooks does not provide its own payroll service, but it integrates with the popular payroll and human resources software provider Gusto. You can register for a free trial version of Gusto software and connect it to FreshBooks before committing to use it.

Disadvantages of FreshBooks

–Restrictions on users and clients

The biggest disadvantage of FreshBooks is its restrictions on users and customers. It only includes one user access to all accounts except for the Select plan (two users are allowed); the cost of additional users is $10 per user per month. The lower-level Lite and Plus plans only allow up to five clients and 50 clients, respectively. If you work alone or own a very small business, these restrictions may not have any impact, but they may make it more expensive for a growing company to scale up.

–Other products provide greater flexibility. QuickBooks Online also has a limit of five users in its most popular Plus plan, but it does not limit the number of customers. Wave does not limit the number of users or customers. Xero does not limit the number of users or customers you can have, but it limits the number of invoices you can send in its plan.

No bank reconciliation or accounting access in the Lite plan

The lowest level plan does not include basic functions such as bank account reconciliation. It also does not allow you to access accountants or bookkeepers. Most accounting software companies provide these basic services even in the cheapest plans.

– No quarterly tax estimates

FreshBooks provides quarterly tax reports, but it does not estimate quarterly income tax payments like QuickBooks Online and some other companies do. However, it does integrate with applications such as Taxfyle, which provide users with upfront quotations for personal or business taxes, and then pair them with a verified CPA or IRS-registered agent to prepare tax payments for them.

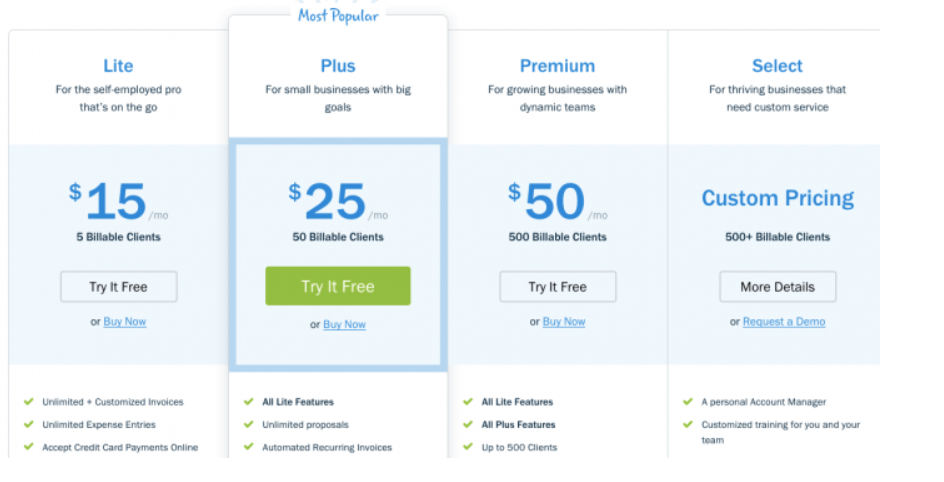

FreshBooks pricing

Freshbooks used to have a free version that only allowed you to charge about 5 customers, but with the launch of the new FreshBooks, they seem to have gotten rid of it. Now they offer a full 30-day free trial of the Plus version.

To be honest, I have never used the free version. I went directly to the payment model. This is worth it.

FreshBooks has three pricing plans to choose from. The difference in plans only depends on how many customers you have:

FreshBooks Lite: $15/month (charged up to 5 customers)

FreshBooks Plus: $25/month (charge up to 50 customers)

FreshBooks Premium: $50/month (charged up to 500 customers)

This pricing is comparable to other products in the industry. Their biggest competitor, QuickBooks,’s “Plus” plan costs $27 per month. Personally think it is a low-quality product.

Generalize

FreshBooks has made great strides since it started as an online invoicing software in 2006. After trying other invoicing applications such as 17hats, QuickBooks and PayPal, and manually creating invoices on Word and sending them in PDF format, I really like how FreshBooks puts everything needed for invoicing and project management in one place, and Make it so easy to use.

The latest version of FreshBooks is very smooth and fast to set up on both the desktop and smart phones. It took about 30 minutes for me to register, set up my account/company profile, and send my first invoice. It took so long because I wandered around the dashboard.

I just hope the pricing is different. As an independent business owner, the greatest value I get in invoicing is the ability to let the software remind me when the invoice is due and automatically send payment reminders to customers.

In general, I think FreshBooks is worth a try, especially because it offers a 30-day free trial of advanced features. However, if you can do everything (manage invoices, project and time tracking, and accounting) with just one application, you may find the features of the Pro plan worth the money.

Unmasking Online Deception: An In-Depth Social Catfish Review

Purple Garden Psychics – ($1/Min) FREE Trial Offers, Real Experience & Benefits And More

Refinancing an Auto Loan: How to Know If It’s a Good Idea

Reverse Mortgages Pros and Cons: Ripoff or a Good Idea?

8 Ways it Just Got Easier to Achieve Student Loan Forgiveness

Unmasking Online Deception: An In-Depth Social Catfish Review

Orchard Bank Credit Cards | NOT a Scam!

PrivacyGuard Review

How to choose where to study as an international student