Crowdstreet : 2022 Best Real Estate Investment Opportunities

Diversifying your portfolio is an important step to take whether you’re an amateur investor or have decades of experience. And while you may think that diversifying the types of stocks, bonds or ETFs you buy will cut it, it may not be the most well-rounded plan for 2021 as many “alternative investments” have changed the landscape for everyday investors.

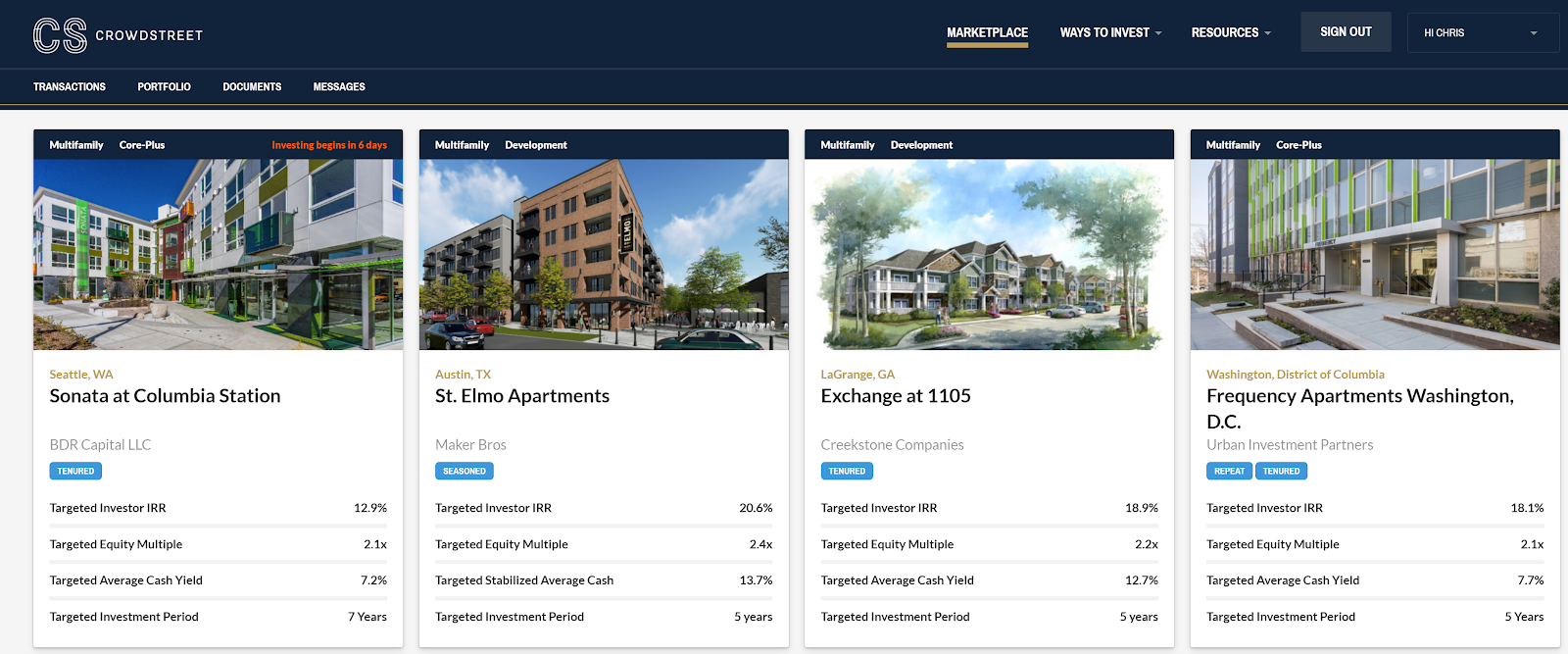

CrowdStreet is a real estate investing platform that gives investors direct access to individual commercial real estate investment opportunities, allowing you to review, compare, and personally choose the deals that meet your own investment criteria. Our managed funds and advisory services give you the same level of access, but we’ll handle the portfolio, making it even easier for you to invest.

Tens of thousands of individual investors have earned millions of dollars in distributions and diversified their portfolio outside of the stock market with commercial real estate.

CrowdSteet Platform Quick Facts:

Expected Annual Rate of Return (IRR) | 17.10% |

Equity Multiple (expected ROI to investor) | 1.39x |

Hold Period (how long your money will held) | 2.3 years |

Fees | 0.50% – 2.50% |

Investment Minimum | $25,000 |

If you’re looking for a platform to get started in real estate investing, CrowdStreet is certainly worth looking into. Here’s what this real estate investing platform can offer.

Get Started With CrowdStreet today!

Summary of CrowdStreet

CrowdStreet is a superbly well-designed platform that accelerates the due diligence process by displaying all of the information you could want in a crisp, efficient manner. Or, if you’d rather save time and trade potential yield for diversification, you can invest in the CrowdStreet Blended Portfolio.

If you’re an accredited investor looking to put away at least $25,000 into a high-yield, long-term investment, commercial real estate is an excellent way to diversify your portfolio and CrowdStreet is the place to do it.

What is CrowdStreet?

Founded in 2014 in Portland, OR, CrowdStreet connects accredited investors to pre-screened commercial real estate investment opportunities.

CrowdStreet is an intermediary, not a special purpose vehicle (SPV). This means that while they do take a small cut, they empower you to connect directly with project sponsors. As mentioned above, this is a big deal because SPVs can cause communication issues or delayed funding. CrowdStreet gives you the freedom to manage your own relationship with your project sponsor.

Although CrowdStreet offers the market’s largest number of investment offerings at any given time, don’t let that fool you into thinking it trades quantity for quality. First, CrowdStreet is strictly commercial-only: there are no residential or fix-and-flip opportunities here.

Second, its sponsor vetting process is rigorous – to say the least – including background checks, reference checks, and more. The acceptance rate speaks for itself: only 5% of deals reviewed qualify for CrowdStreet.

How does investing with CrowdStreet work?

You can begin investing with CrowdStreet in three quick steps:

Create an account.

Complete your investor profile.

Browse deals and invest.

There are two noteworthy elements of the account creation process.

First, if you’d like to browse deals before committing all of your information, CrowdStreet lets you begin the browsing process as soon as you enter just your name, email, and password.

You can begin browsing CrowdStreet deals as soon as you create a basic account

Second, CrowdStreet will ask you multiple times to confirm whether you’re an accredited investor or not. But more on that in a bit.

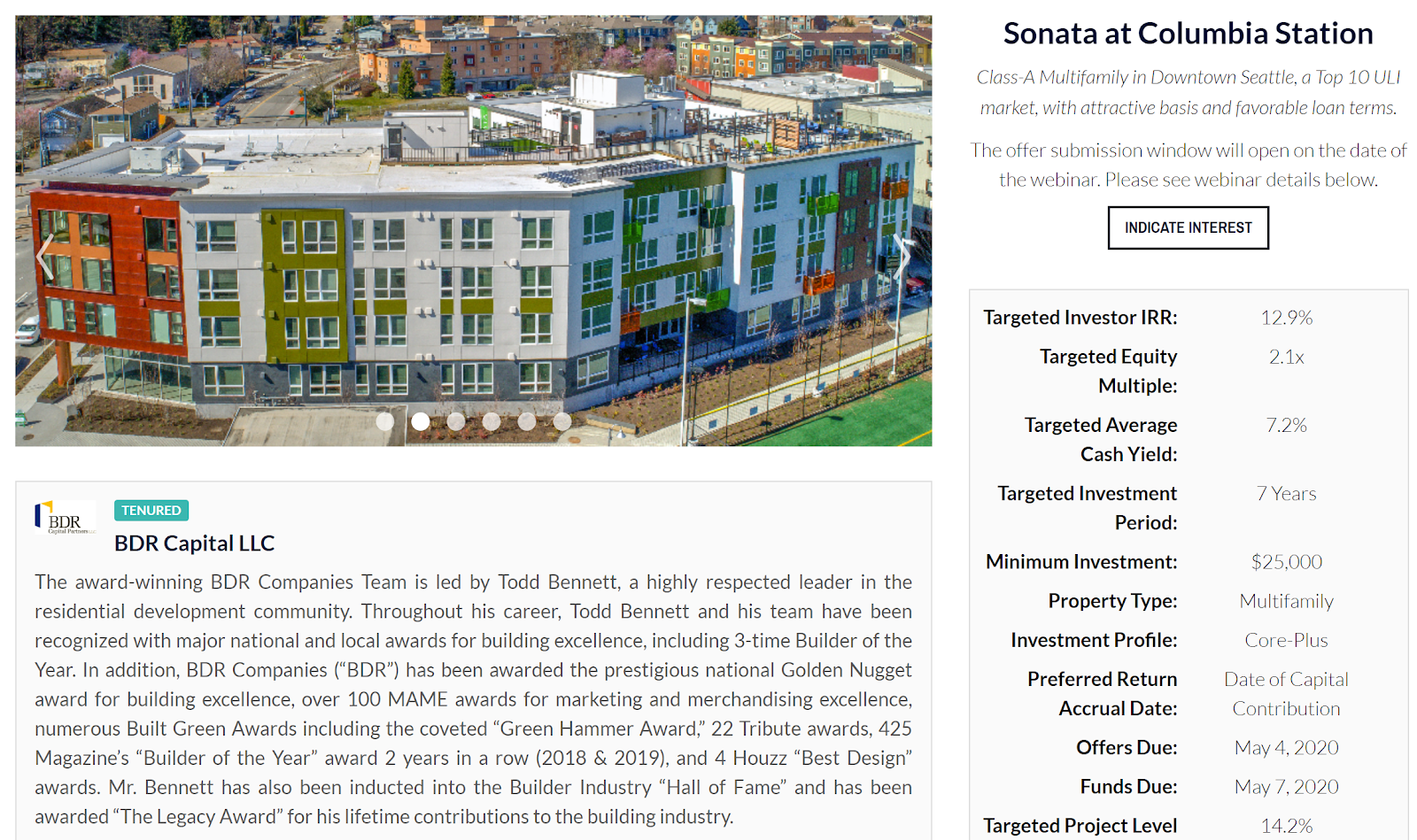

Once you begin browsing deals you’ll discover how easy it all is. As a potential investor about to plunk down new car money, all of the information you could possibly want on a given deal is cleanly presented, including:

Photo and video.

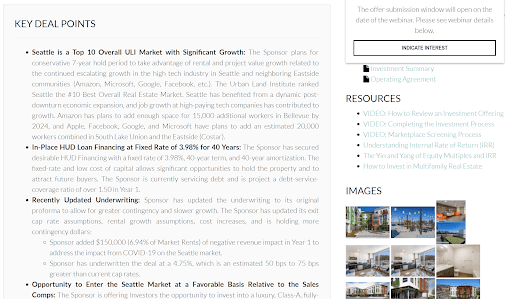

Key deal points.

The business plan.

The capital stack.

Live webinar invites and recordings.

Essential documents.

Site plan, unit plans, amenities, etc.

Sponsor info w/ track records.

Q&A forms.

And more.

You’ll find essential deal information at the top like sponsor info and minimum investment

Below you’ll find a deal summary and a plethora of additional resources

In short, CrowdStreet organizes an astonishing level of information for each deal it posts in a crisp and clean manner.

CrowdStreet has clearly met the Herculean task of simplifying the commercial real estate investment process. The site is astonishingly robust and easy to use, so much so that other crowdfunding or investment platforms could learn a lot from it.

So why did CrowdStreet ask if I’m an accredited investor?

Accredited investors are persons, entities, or funds that meet certain requirements for net worth and thus have access to greater investment opportunities. The SEC created accreditation to protect less wealthy and experienced investors from high-risk opportunities.

To qualify to the SEC as an accredited investor you must meet at least one of the following criteria of personal wealth:

Have individual net worth, or joint net worth with a spouse, that exceeds $1 million (excluding the value of your primary residence).

Have individual income exceeding $200,000, in each of the past two years and expect to reach the same this year.

Have joint income with a spouse exceeding $300,000, in each of the past two years and expect to reach the same this year.

Invest on behalf of a business or investment company with more than $5 million in assets and/or all the equity owners are accredited.