LoanDepot Reviews 2022

Overview

In an industry made up of financial giants, loanDepot is a new thing. It has only been around since 2010.

During that time, though, loanDepot has grown into one of the largest home mortgage lenders in the U.S.

It’s known for deploying innovative mortgage technology that makes the home financing process smoother and faster for customers — especially those willing to do business online.

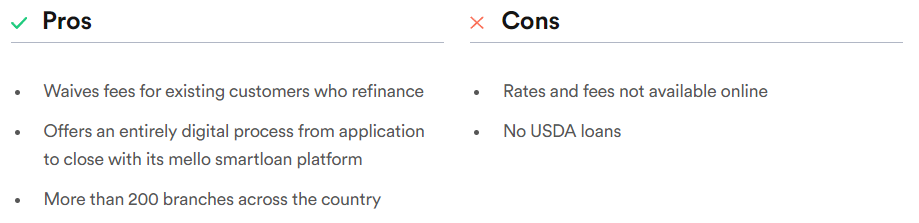

Overall, loanDepot is a strong contender if your main goal is to get a mortgage or refinance with the least amount of hassle.

Be sure to compare rates and settlement costs, and make sure loanDepot’s pricing is competitive for you as well.

LoanDepot Mortgage Rates

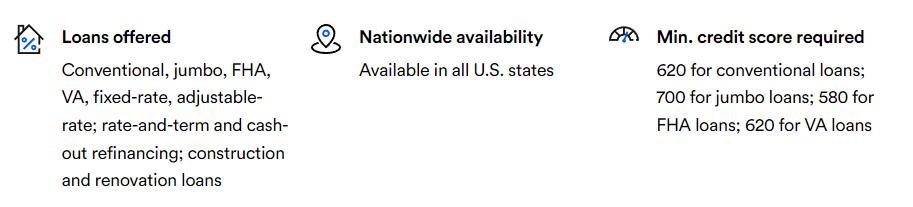

LoanDepot does not display current mortgage or refinance rates on its website. You must request a quote to view loanDepot’s rates, which requires you to add your personal details and contact information.

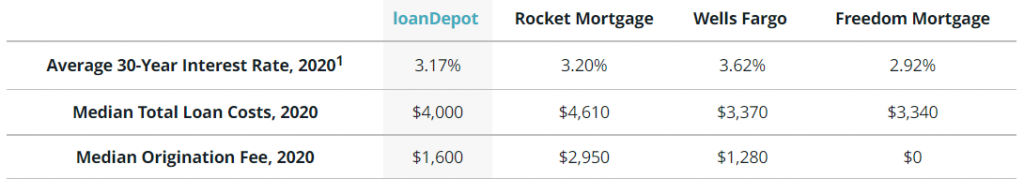

However, by looking at the 30-year average rates from 2020 (the latest data available), we do see how loanDepot mortgage rates stack up.

On average, loanDepot’s mortgage rates appear to be a bit lower than those of its competitors, while its lender fees are mid-range.

Average 30-Year Mortgage Rates from Major Lenders

Suitable for

Borrowers looking for a digital loan experience can choose to seek in-person assistance at more than 200 U.S. locations

Loan Type

traditional

treasure

FHA

will

fixed rate

adjustable rate

Interest rate and term and cash refinancing

Construction and renovation loans

Lender Fee

LoanDepot does not list lender fees online.

Fame

LoanDepot has an A+ rating from the Better Business Bureau. Based on more than 3,600 customer reviews on Trustpilot, the lender has a 3.7 out of 5 stars. When it comes to originating loans, LoanDepot scored an above-average 856 out of 1,000 in JD Power’s recent customer satisfaction rankings. Borrowers are also satisfied with the way lenders service their mortgages: It was ranked eighth in JD Power’s research, with a score of 18 points above the industry average.

Online service

LoanDepot’s website includes a “knowledge cafe” that provides educational resources on buying and owning a home, and borrowers can easily apply online and make monthly payments. The mello smartloan platform is designed to verify all your documents and credit reports in about 7 minutes (but not all borrowers are eligible for the tool) and facilitate a paperless process.

Minimum Borrower Requirements

LoanDepot complies with government sponsored enterprise (GSE) Fannie Mae and Freddie Mac approved mortgage requirements, as well as Federal Housing Administration (FHA) and U.S. Department of Veterans Affairs (VA) backed mortgage requirements.

For traditional loans, key requirements include good credit (usually a FICO score of 620 or higher) and a minimum down payment of 3%.

Refinance with loanDepot

Refinancing with loanDepot does have one major benefit: a “lifetime guarantee”. If you take out a mortgage through loanDepot and then refinance with the company,it will forgive your loan fees and repay your appraisal fees.

However, if you refinance a loan from a different lender, you will pay a fee. The exact fee you pay will vary, depending on factors such as the type of loan and where you live.

However, thanks to the lender’s recent improvements to their online application software, you may be able to close your loan faster. ‘mello smartloan’ is an end-to-end online application that helps you find the best loan for your situation, verify your financial and employment details, extract your credit and process other details of your loan – all with Completed in a faster time compared to the industry average.

Unmasking Online Deception: An In-Depth Social Catfish Review

Purple Garden Psychics – ($1/Min) FREE Trial Offers, Real Experience & Benefits And More

Refinancing an Auto Loan: How to Know If It’s a Good Idea

Reverse Mortgages Pros and Cons: Ripoff or a Good Idea?

8 Ways it Just Got Easier to Achieve Student Loan Forgiveness

Unmasking Online Deception: An In-Depth Social Catfish Review

Orchard Bank Credit Cards | NOT a Scam!

PrivacyGuard Review

How to choose where to study as an international student