Credit

What Credit Score is Needed to Buy a Car?

What credit score is needed to buy a car? That question is relevant to anyone who is looking to buy a car, but especially those who fall into the average or below-average credit score ranges.

The better your credit score is, the more options you’ll have with interest rates.

But if you have a lower score, you’ll either need to improve it or use an alternative financing strategy that we’ll cover later in this article.

But let’s start by discussing the basics of a credit score needed to buy a car.

Table of Contents:

- What Credit Score Is Needed To Buy a Car?

- What is a GOOD Credit Score To Buy a Car?

- What You Can Do to Improve Your Credit Score for a Car Loan

- How to Get a Car Loan Approval with a Bad Credit Score

What Credit Score is Needed to Buy a Car?

One of the factors that make what credit score is needed to buy a car a bit complicated is that the auto financing industry is much more diverse than other types of loans, like mortgage lending.

In that industry, most loans are sold to enormous mortgage agencies, like Fannie Mae, Freddie Mac, and Ginnie Mae. Auto financing is completely different. There are hundreds of auto loan lenders, from banks and credit unions to financing companies. For that reason, the credit score needed to buy a car is difficult to pinpoint precisely.

Generally speaking, you should be able to get prime financing with a credit score in at least the 650 to 660 range. Many credit unions and some banks make prime financing available at scores that low. Naturally, the higher your credit score, the lower your interest rate will be.

The best financing arrangements will usually begin between 680 and 700. But for the very lowest interest rates possible, a credit score of at least 720 or 750 may be required. Again, it all depends on the lender.

If your credit score falls below the 650/660 range, you’ll fall into the subprime loan category. If you do, you may be charged double-digit interest rates. And if your score is well below that range, like 550 or below, you’ll be at the mercy of a lender selected by the dealer. Interest rates on that type of financing can quite literally be all over the map.

What is a Good Credit Score to Buy a Car?

The credit score needed to buy a car isn’t just about a loan approval. Just as important, it has a significant impact on the rate you’ll pay on your loan once it’s approved.

Since a low credit score is a significant predictor of loan delinquency and default, a lender will charge a higher rate to offset that risk. By contrast, the higher your score, the lower your interest rate will be, due to reduced risk.

To get an idea of how much difference credit scores can make with a car loan, we’ve turned to the source of FICO scores themselves, myFICO.com.

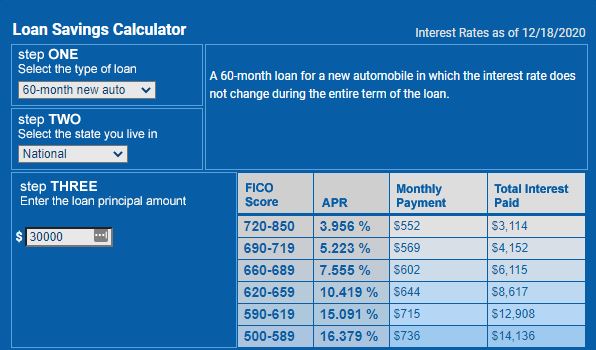

The screenshots below are from their Loan Savings Calculator, that enables you to run various loan scenarios for both car loans and mortgages, based on different loan amounts, terms, and credit scores.

The first screenshot shows the impact of credit scores on a $30,000 loan for a brand new car. Using a term of 60 months, you can see the monthly payments and total interest paid for six different credit score brackets:

Notice that the highest FICO Score bracket, 720 to 850, has the lowest APR at 3.956%. That results in a monthly payment of $552, with $3,114 in total interest paid over the life of the loan.

But drop down to the fourth FICO Score bracket, at 620 to 659, and the interest rate rises to 10.419%. That results in a monthly payment of $644, with $8,617 in total interest paid over the life of the loan.

Not only is the interest rate in this score bracket nearly 6.5 percentage points higher, but the monthly payment is also more by $92. That means the annual cost of financing the loan will be higher by $1,104, or $5,503 over the life of the loan.

Used Cars: Same Situation

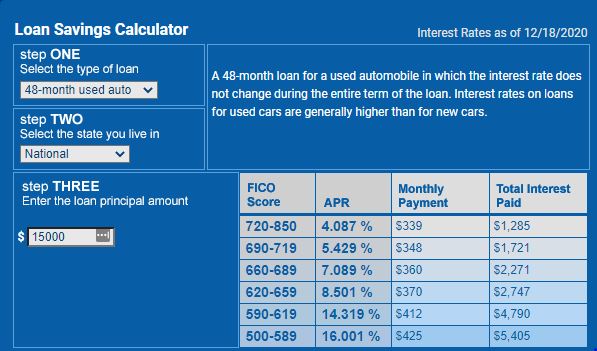

The credit score/interest-rate/monthly payment connection is similar with used cars. In the example below, we ran a comparable scenario, except it involves a used car with a $15,000 loan amount and a 48-month term:

Once again, if you look at the top line for the highest FICO Score range, 720 to 850, the APR is 4.087% – which is only slightly higher than the rate for the highest credit score range for a new car loan. The monthly payment is $339, and total interest of $1,285 is paid over the life of the loan.

But when we drop down to the fourth credit score range, 620 to 659, the interest rate jumps to 8.501%, with a monthly payment of $370, and total interest paid at $2,747 over the life of the loan.

Notice, however, that even though interest rates are higher on lower credit scores on used cars – just as they are for new cars – the difference isn’t as dramatic. In the two examples above, the difference in monthly payment is just $31, or $372 per year. Over the four-year term of the loan, the total difference is $1,462.

That doesn’t come close to the $5,503 difference on new cars. But it still increases the total cost of owning the vehicle.

Based on the examples for both new and used car loans, it’s to your advantage to do whatever you can to improve your credit score before applying for an auto loan.

What You Can Do to Improve Your Credit Score for a Car Loan

One of the disadvantages of improving your credit score for a car loan is that you often don’t have the kind of time you might if you were applying for a mortgage. If you purchase a home or even refinance your current one, you often know months or even years in advance. That will give you plenty of time to do what’s needed to improve your credit score before applying for financing.

The situation is often very different from car loans. In many cases, the decision to purchase a new vehicle is sudden, often resulting from an auto accident with severe damage to your car, or a major repair that renders the vehicle not worth fixing. You may have only days to obtain financing, which will leave little time for advanced preparation.

If that describes your situation, you’ll need to work with the financing options immediately available. We’ll offer strategies for a sudden car loan situation in the next section.

Strategies to Raise Your Credit Score

If you’re not in the car market right now, this is the perfect time to begin preparing your credit score for a car loan. Because you have no immediate need for a car or a loan, you’ll have the luxury of time to prepare.

Even if you don’t plan to buy a car for at least another year, this is the time to begin monitoring your credit score on a regular basis. If your credit score doesn’t look like it’ll allow you to get advantageous financing, take steps now to improve the situation.

Help Improve Your Credit Score

- Make ALL payments on time from this point forward.

- Have any negative errors removed from your credit report.

- Pay down or pay off credit cards or loans to lower your credit utilization ratio.

- If you have any past due balances or collections, pay them off immediately.

The sooner you act on any or all of the above, the greater the improvement in your credit score will be. That’s because some credit improvement strategies need time to produce the biggest gains.

If you get started now, before you need financing, you’ll be ready when the time comes. And it’s probably something close to a 50% chance that when it does, it’ll be sudden.

No matter if it does play out that way – you’ll be prepared when it does.

How to Get a Loan Approval with a Bad Credit Score

What options do you have if you have an immediate need for financing for a car, and don’t have time to improve your credit score?

Fortunately, there are at least six strategies to choose from:

1. Get a preapproval from your regular bank

The bank where you have your checking and other accounts is likely to take a more favorable view of your car loan application than a totally new lender. Credit unions can be an even better option since they often make favorable rates available on credit scores as low as 650. However, if your score is below 650, even credit unions may not be an option.

But if you can get a preapproval from your regular bank or credit union, it serves two very important purposes:

- It enables you to have your financing in place before you buy a car, making you a stronger buyer.

- It can force the dealer to get you a better financing deal than the one offered by your bank or credit union.

This is why applying at your bank or credit union should be your first option.

2. Shop between lenders

If you rely on a single lender to get you the best deal, especially when you have average, fair, or poor credit, you’ll be setting yourself up for a bad deal. Shopping is always an advantage, but particularly when you don’t have good or excellent credit.

Even if you get a preapproval from your bank or credit union, shop at several more lenders and always be open to financing arrangements proposed by the car dealer. You owe it to yourself to get a better financing deal if one is available.

3. Buy a used car

In the two financing examples we performed earlier, the interest rate spread based on credit score ranges is lower on used cars than it is on new cars. If your credit score is average or less, you may get a better deal buying a used car.

This is in part because the loan amounts on used cars are usually much lower than what they are new cars. In addition, the depreciation of used cars is much lower than it is in new cars. Because of the reduced risk coming from two directions, lenders are often able to offer more advantageous rates on used cars than on new ones.

4. Make a larger down payment

One of the limitations that almost always results in higher interest rates on car loans is very low or nonexistent down payments. 100% financing is extremely popular, especially if your current vehicle doesn’t represent much in the way of trade-in value. But it will set you up for a higher interest rate.

It may be possible to lower your interest rate either by making a down payment or by making a larger down payment.

Instead of taking 100% financing, go with 90%. If it’s possible, put down 20%, with 80% financing. Not only can that result in a lower interest rate, but it can be the difference between loan approval and denial if your credit is fair or poor.

Making or increasing the down payment not only reduces the loan amount, but it also gives you “skin in the game.” That will make it less likely you’ll default on the loan and lose the vehicle. Lenders are aware of this, and are often more receptive to approving loans with a larger down payment.

5. Reduce the loan term

In the lending industry, the longer the loan term, the greater the risk the loan carries. That’s why interest rates on short-term loans are lower than those on longer ones. A good example is a difference in interest rates between 15-year mortgages and 30-year mortgages.

The same applies to car loans. If you can reduce the loan term from 60 months to 48 months, 42 months, or even 36 months, you’ll get a better interest rate.

6. Add a cosigner

If all the above strategies fail, the best option may be to add a qualified cosigner to the loan. The lender will make the loan based on the credit profile of your cosigner, which can give you access to much lower interest rates even if your own credit is fair or poor.

So, What Credit Score Do You Need to Buy a Car?

What credit score do you need to buy a car? That’s a question best asked and addressed before you need to get a loan to buy a car.

As you can see, your credit score plays a major role in the interest rate you’ll get on your car loan, which is a significant part of the overall cost of the vehicle. Anything you can do to improve your credit score before applying for financing has the potential to save you thousands of dollars.

But if you need a car right away, and there’s no time to improve your credit score, use one of the six strategies outlined above to get a better deal.

A car is one of the biggest expenses in the average household budget. You owe it to yourself to do whatever is necessary to lower that cost. Improving your credit score for a car loan, or making an end-run play around your credit score, are the best ways to make that happen.

Unmasking Online Deception: An In-Depth Social Catfish Review

Purple Garden Psychics – ($1/Min) FREE Trial Offers, Real Experience & Benefits And More

Refinancing an Auto Loan: How to Know If It’s a Good Idea

Reverse Mortgages Pros and Cons: Ripoff or a Good Idea?

8 Ways it Just Got Easier to Achieve Student Loan Forgiveness

Unmasking Online Deception: An In-Depth Social Catfish Review

Orchard Bank Credit Cards | NOT a Scam!

PrivacyGuard Review

How to choose where to study as an international student