Credit

Remove Late Payments From Your Credit Report

Late payments can be a big deal.

They count significantly toward your FICO score calculation which so many lenders check when you apply for a loan.

However, in my experience, it’s really not that difficult to get late payments removed and see a bump in your credit score.

How Long Do Late Payments Stay On Your Credit Report?

Late payments can stay on your credit report for seven years. This will affect your ability to get loans.

A lower credit score will also affect the interest rates you get if you do get approved for a credit card or auto loan.

So I recommend you take steps to get missed payments off your credit report before applying for new credit again.

First, I strongly recommend monitoring your credit report to see right when items are removed and so you can keep track of your progress.

Experian offers free access to your credit report on a monthly basis with free credit report monitoring too.

And you can get a free credit report from each of the three credit bureaus every week — instead of once a year — through April of 2021 because of the Covid-19 pandemic.

Visit annualcreditreport.com to access your Equifax, Experian, and TransUnion credit reports. I’ll suggest a few more ways to monitor your credit score for free below.

Can I Remove Late Payments From My Credit Report?

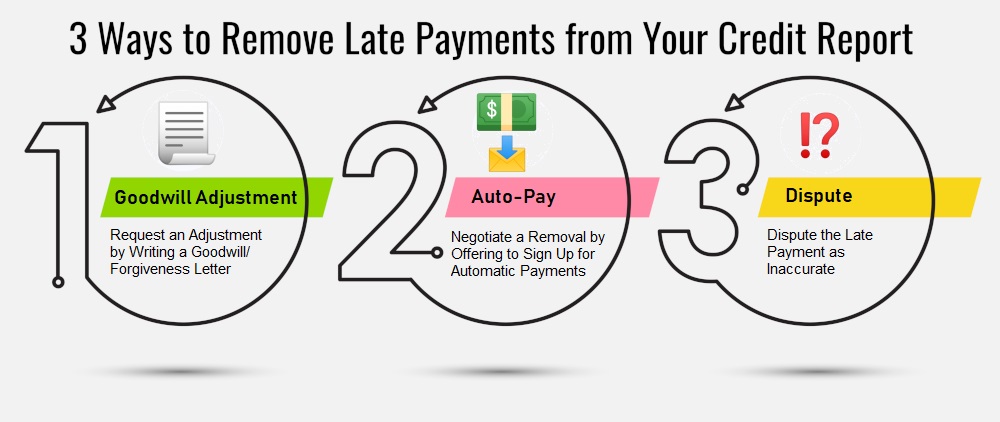

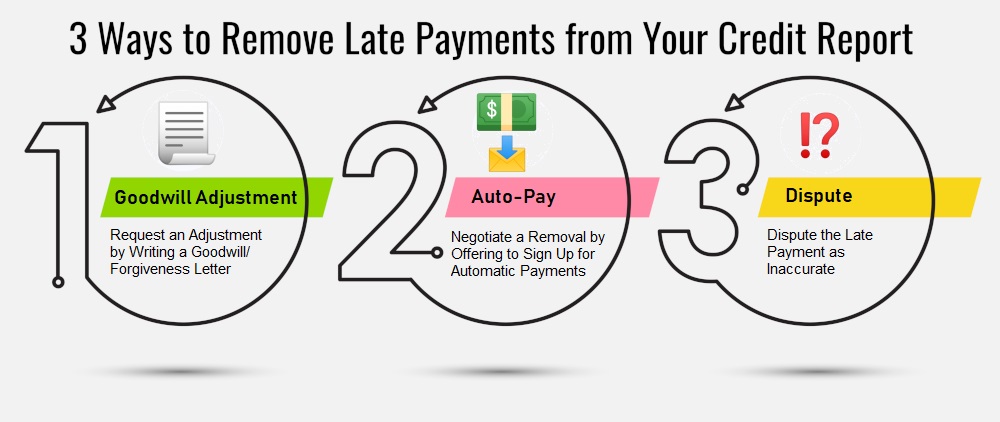

Here are 3 proven ways to remove late payments from a credit report:

- Request a “Goodwill Adjustment” from the Creditor

- Negotiate to Remove a Late Payment by Signing Up for Auto-Pay

- Dispute the Late Payment Entry on Your Credit Report as Inaccurate

1. Request a “Goodwill Adjustment” from the Original Creditor

The idea is simple, and it works surprisingly well.

Many times creditors are happy to grant “goodwill adjustments” if your previous payment history is relatively good and you have established a good relationship with the creditor.

This is probably the easiest and surest way to get a late payment removed from your credit report.

The process involves writing the creditor a letter explaining your situation (why you were late) and asking that they “forgive” the late payment and adjust your credit report accordingly.

The easiest way to write a goodwill/forgiveness letter is to use the sample letter I created as a template. This method might not work if you have multiple late payments.

Ads by Money. We may be compensated when you click on this ad.

Ad

Talk to a professional about removing late payments Want to remove late payments on your credit report? Click your state to find help. Hawaii Alaska Florida South Carolina Georgia Alabama North Carolina Tennessee RI Rhode Island CT Connecticut MA Massachusetts Maine NH New Hampshire VT Vermont New York NJ New Jersey DE Delaware MD Maryland West Virginia Ohio Michigan Arizona Nevada Utah Colorado New Mexico South Dakota Iowa Indiana Illinois Minnesota Wisconsin Missouri Louisiana Virginia DC Washington DC Idaho California North Dakota Washington Oregon Montana Wyoming Nebraska Kansas Oklahoma Pennsylvania Kentucky Mississippi Arkansas Texas Contact an Expert at Lexington Law

Talk to a professional about removing late payments Want to remove late payments on your credit report? Click your state to find help. Hawaii Alaska Florida South Carolina Georgia Alabama North Carolina Tennessee RI Rhode Island CT Connecticut MA Massachusetts Maine NH New Hampshire VT Vermont New York NJ New Jersey DE Delaware MD Maryland West Virginia Ohio Michigan Arizona Nevada Utah Colorado New Mexico South Dakota Iowa Indiana Illinois Minnesota Wisconsin Missouri Louisiana Virginia DC Washington DC Idaho California North Dakota Washington Oregon Montana Wyoming Nebraska Kansas Oklahoma Pennsylvania Kentucky Mississippi Arkansas Texas Contact an Expert at Lexington Law

2. Negotiate Removal by Offering to Sign Up for Automatic Payments

I have never actually tried this method myself, but from what I understand creditors frequently offer to remove late payment entries if you, in exchange, agree to sign up for automatic payments.

This strategy works well for both parties: the creditor can ensure future on-time payments will be made, and you don’t have to worry about remembering to make payments or being charged late fees if you forgot to pay by the due date.

I would love to hear from those of you who have succeeded with this method!

Update: Several readers have verified that this method did work for them, so try this next if a goodwill letter doesn’t work.

Of course, automatic payments are only good when you have the money in your bank account to cover the transaction.

3. Dispute the Late Payment as Inaccurate

I certainly do not advocate lying or claiming negative information is inaccurate when you know that you really did make late payments.

BUT, if you find ANY inaccuracies on the late payment entry (dates, amounts, etc), you can dispute the late payment as inaccurately reported.

Sometimes creditors have a difficult time verifying the exact details of your account history.

Therefore, if you write a dispute letter protesting the inaccurate late payment and the creditor can’t (or simply doesn’t bother) to verify it, the negative entry can be removed in accordance with the Fair Credit Reporting Act (FCRA).

Accurate information from your creditor should include:

- Your name

- Creditor’s name

- Payment information

- Account number

This is also a great technique on how to remove collection accounts from a credit report.

4. Have A Professional Remove The Late Payments

We understand that credit repair can be overwhelming. If you’d rather have a professional credit repair company help, I suggest you check out Lexington Law Credit Repair.

Credit repair experts like the ones at Credit Saint, Sky Blue, and Lexington Law may be able to remove inaccurate negative information on your behalf.

Just to be clear: Credit repair companies won’t do anything you can’t do yourself. But think of it this way — if someone does it all day every day, they are going to get good at it. Attempting credit repair alone can feel overwhelming.

Credit repair companies will typically charge a monthly subscription fee while you work with them but they’re also easy to cancel and there’s no long-term commitment. For someone with items that can be challenged, a lot of time progress can typically be made in 45 or 90 days.

Ask Lexington Law for Help

How Much Does a Late Payment Hurt My Credit?

A single late payment can have a bigger impact on your credit file than you may think.

If you have perfect or near-perfect credit, a late payment could knock upwards of 100 points off your FICO score.

That’s because payment history comprises 35 percent — the biggest chunk — of your credit score.

When you already have excellent credit, you have more room for one negative item to take a big hit.

A single late payment will have a smaller impact if your credit file already has some problems such as multiple late payments or a charge-off or collection account.

How to Keep Late Payments Off Your Credit File

If you’re reading this and already have delinquencies reported on your credit report, it’s obviously too late to prevent the negative marks from appearing in your credit history.

You should stick to the methods I outlined above to remove the late payments and restore your credit.

But if you aren’t yet 30 days late on a payment, read this section carefully. You can still prevent a late payment from hurting your credit score.

Doing this will be much easier than trying to remove the negative items later.

Here’s what you can do:

Communicate with the Credit Issuer

It’s tempting to ignore past due bills, especially from credit card companies that can’t turn off your utilities or repossess your car. But try to avoid this temptation.

A lot of credit accounts offer payment flexibility you should take advantage of if you’re struggling to make on-time payments.

Some companies will let you skip a payment so you can get your personal finances back on track.

But you won’t know about these possibilities if you don’t get in touch with your creditor.

So don’t ignore their phone calls or emails, especially when you’re still not 30 days late.

Use Covid-19 Relief Programs If Possible

During the coronavirus pandemic a lot of creditors, such as student loan servicers, froze credit accounts.

Other creditors started Covid-19 relief programs for account holders who had been affected by the pandemic.

Still, others stopped sending late payment information to the credit bureaus or selling charge-off accounts to collection agencies.

This kind of help can help keep your accounts in good standing and help you keep good credit during challenging times.

But you may need to ask your creditor to enroll you in these programs. Again, communicating with your creditor before your account becomes 30 days or more delinquent will be key.

Change Due Dates or Consolidate If Helpful

Most credit card issuers such as Capital One and Discover will let you change your due date to avoid payment conflicts with other bills such as your rent or auto loan payment.

Sometimes a simple change like this can create the relief you need to keep your credit score on the up and up.

You could also consider consolidating several smaller credit card balances into one larger credit card or personal loan.

You’d have fewer due dates to remember, and you could probably pay less in interest charges, too.

Knowing Your Rights Can Help You Negotiate

Congress has passed several laws to help consumers negotiate with credit reporting agencies and creditors.

The Fair Credit Reporting Act, for example, gives you access to your credit file for free every year.

Visit annualcreditreport.com to get your free credit reports from the three credit reporting bureaus.

If you discover inaccurate information, the law requires the bureaus to fix this information or remove it.

Be sure to file a complaint with the Consumer Financial Protection Bureau if your attempts to remove inaccurate negative information get no response.

Monitoring Your Credit Can Help Prevent Problems

Yes, you can get your free credit report, but some credit card companies and mortgage servicers offer free credit monitoring that’s built into your everyday life.

You can just log into your account online or tap on an app to see your FICO or VantageScore anytime.

You can also monitor your credit using free apps like Credit Sesame and Credit Karma. These apps won’t show your official FICO score but they can alert you to big changes.

A big and sudden change to your credit score could be a sign of identity theft or of inaccurate late payments being reported by one of your creditors.

Detecting this kind of problem early will make fixing it easier.

Unmasking Online Deception: An In-Depth Social Catfish Review

Purple Garden Psychics – ($1/Min) FREE Trial Offers, Real Experience & Benefits And More

Refinancing an Auto Loan: How to Know If It’s a Good Idea

Reverse Mortgages Pros and Cons: Ripoff or a Good Idea?

8 Ways it Just Got Easier to Achieve Student Loan Forgiveness

Unmasking Online Deception: An In-Depth Social Catfish Review

Orchard Bank Credit Cards | NOT a Scam!

PrivacyGuard Review

How to choose where to study as an international student