Credit Cards

How To Increase Your Credit Limit – The Right Way

Balance Transfer Tricks | What Credit Card Companies Don’t Want You To Know

Asking for a higher credit limit can feel awkward.

Some cardholders think asking for more credit makes them seem desperate. (This isn’t really an issue.)

Others think they’ll hurt their credit score by asking for a credit limit increase. (In some cases this is true.)

Some credit card account holders just don’t know who to ask about getting more credit.

So today let’s separate fact from fiction so you’ll know how and when to ask for a credit line increase.

How Credit Limits Are Set

Credit card companies extend higher credit limits to people with higher credit scores because data shows people with good credit scores are more likely to pay their credit card bills on time and not default.

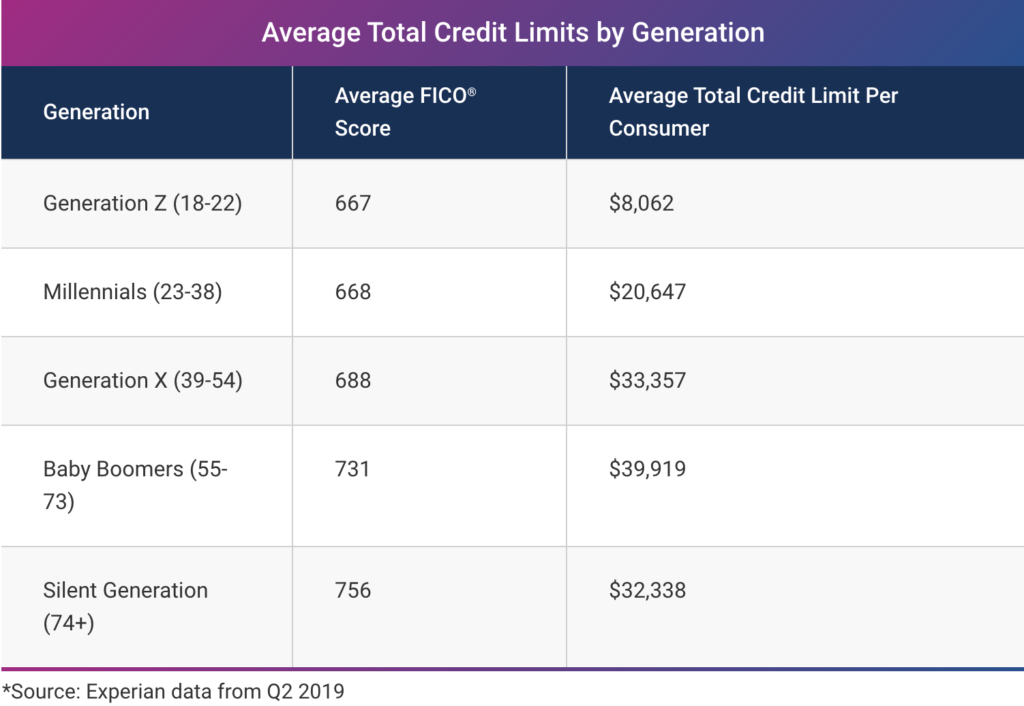

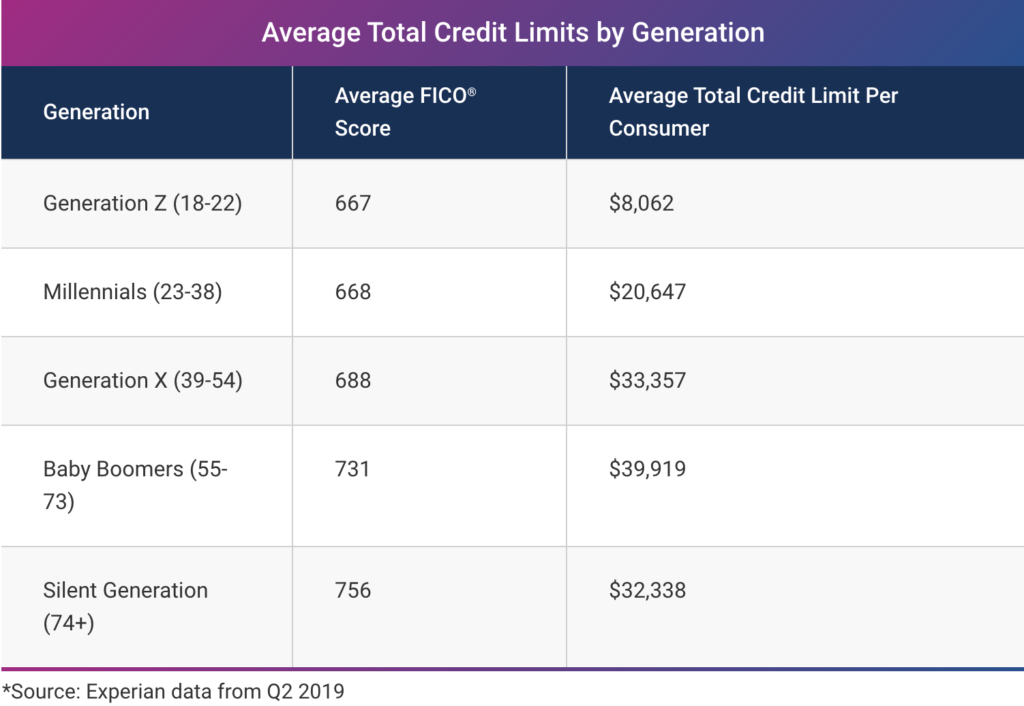

The average total credit limit in 2019 was $22,751 according to data from Experian, the credit bureau. (This number reflects a borrower’s total credit — not an individual card’s limit.)

Here are the average credit limits based on ages and average credit score from Experian:

As you can see, credit limits increase with age. People typically earn higher annual incomes and pay down their debt later in life, which can improve their credit score and borrowing power.

These numbers show the way credit card companies do business. An account holder with a lower credit score will have a harder time convincing Capital One, American Express, or any other credit card company to extend a higher credit limit.

But it’s not impossible.

How To Ask For an Increased Credit Limit

To ask for a larger credit limit, just call your credit card provider and ask. Look for the phone number on the back of your card or log into your account to submit your request online. Many card servicers have mobile apps with built-in ways to request a credit limit increase.

Ask the customer service representative to consider your years of membership, strong payment record, and low credit utilization rate.

If your household’s annual income has gone up since your credit line was last extended, tell the customer service representative.

If you have a low credit score, you could still ask for a higher limit. You may get just a small credit line increase, but every little bit can help!

If you have an emergency car repair bill, a $1,000 credit line increase may be all you need.

Don’t Act ‘Desperate’ or ‘Greedy’

Banks like to loan money to people who don’t really need the money. It’s frustrating, but it’s how they do business.

You may get additional credit by telling the rep about your money troubles, but this isn’t likely to work more than once.

Instead, tell the bank why you deserve a higher amount of credit. Even if you have a lower credit score, don’t be afraid to make your case.

If you have made a late payment or have a higher than ideal credit utilization ratio, you should acknowledge this. But don’t make excuses. Just share the reasons for your credit blemishes if asked.

At the same time, you don’t want to ask for too much or seem too confident. For example, don’t insist the rep double your credit limit.

Instead, ask for 10 to 25% more — up to $250 for every $1,000 in credit you already have. If you have excellent or even good credit, you may be able to ask for more.

Ask Again in Six Months

If you get denied but still need the credit line increase, wait six months before you ask again. Keep your account in good standing throughout these six months.

And, during that wait, be the best borrower you can be on all your accounts. Pay all your credit card bills on time. The same goes for student loans, monthly housing payments, and even utility bills.

Check Your Credit Score Before Asking

Knowing your credit score in advance, before you ask for a credit limit increase, can save you some trouble.

A lot of borrowers don’t ever check their credit reports from Experian, TransUnion, and Equifax. They learn about credit problems when they apply for a new credit card or loan — or in this case, for a credit limit increase.

You can visit annualcreditreport.com to get a free credit report from each credit bureau. Checking your credit will not hurt your credit score because checking your credit doesn’t require a hard credit pull.

If you have poor credit you may want to consider getting a secured credit card which gives you a chance to build a solid payment history.

When To Ask For a Credit Limit Increase

When you ask for a credit limit increase, your request will be treated as if you were applying for a new credit card. The card issuer will check your credit history to determine your creditworthiness.

Should You Pay Your Tax Bill With a Credit Card?

This brings us to the first rule about asking for a credit card limit increase:

Ask About Only One Card at a Time

You should avoid asking to increase the available credit limit on two or more cards simultaneously.

If you do, you’ll get multiple hard inquiries on your credit report at one time. Too many hard pulls could lower your credit score which lowers your chances of getting the credit limit increase.

So pick one of your credit cards to increase.

Ask When Your Haven’t Gotten a New Credit Card Recently

Along the same lines, you should ask your credit card issuer for a credit limit increase if you’ve recently gotten a new credit card or loan.

Once again this is because new credit applications require hard pulls which could lower your score if you pile up too many in a short period of time.

Wait Until You Have Lower Debt Before Asking

Your credit utilization ratio makes up 30% of your FICO score. When you have credit card balances approaching their limits, your credit utilization rate will be high, and this will hurt your chances of getting a higher limit.

This creates a Catch 22 for many borrowers: You need more credit because your credit limit is almost gone — yet your high credit utilization ratio makes it harder to get the additional credit.

So try to ask for a credit line increase before you’ve used up most of your available credit. Or, try to pay down your debt to improve your credit score before asking.

Wait Until You Have a Solid Payment History

Payment history makes up 35% of your FICO score. If you’ve missed several payments lately on a variety of loans, don’t ask for a credit line increase just yet.

Wait until you’ve made on-time payments for at least three months. Your credit limit increase request will gain more traction when you have a solid payment history.

Alternatives to a Credit Card Line of Credit Increase

Personal finance problems come with a variety of solutions. If you can’t get a higher line of credit on a credit card, consider another solution to your financial situation:

A Personal Loan Has Advantages

Most banks and credit unions offer personal loans that are unsecured, much like a credit card.

These loans also depend a lot on your credit history because they don’t have collateral like a mortgage or an auto loan.

Personal loans have fixed terms and interest rates which mean you’ll have a set monthly payment. You can check your bank’s online account for loan options.

Along with your credit score, your employment status and debt-to-income ratio will affect your eligibility.

Consider a Home Equity Line of Credit

If you own your home and have some equity built up, you could access your equity with a home equity line of credit.

These lines of credit have backing from the value in your home. Your bank or mortgage lender can offer significantly lower interest rates — compared to a credit card lender — because of this collateral.

Apply for a New Credit Card Only If Necessary

If you’re in a real bind, another option is to apply for a new credit card with a new company — a company that offers cards to applicants with lower credit scores.

If you do get a higher credit limit or a new card, be sure to pay the bill in full when it comes due so that you don’t have to pay interest charges. Don’t use your larger available credit to spend at a level you can’t sustain.

Some credit cards have automatic credit limit increases that kick in after a year of on-time payments or some other pre-set criteria.

But even the best credit cards for people with bad credit charge high annual fees and even some monthly fees.

Check with credit card lenders like Bank of America, Chase, Citi, or Capital One — all of which have dozens of options in their credit card lineups. You won’t get many rewards credit cards with poor credit, but you may find what you need.

Consider a Balance Transfer Card

A balance transfer card could create some extra room in your available credit. These cards are designed to pay off your other credit cards and lower your monthly payments.

You have to be careful not to overspend if you get a higher available credit limit this way. Too many borrowers get into worse trouble because they change their spending habits and pay only the minimum payments — running up all their lines of credit.

But if you can manage your spending habits after transferring your old balances to your new credit line, a balance transfer card may increase your total credit.

Improving Your Credit Score With A Higher Credit Card Limit

People who ask for a higher credit limit often have big plans such as home improvements or they want to avoid going over their existing credit limits.

But there’s another advantage to seeking a credit limit increase — it can improve your credit score.

Your total credit limit helps determine your credit utilization ratio, and a lower ratio can lead to a higher credit score.

Increasing your total credit limit — without increasing your credit card balances — will lower your credit utilization ratio.

Just as adding another credit card to your wallet will increase this ratio. So will increasing the credit limit on a card you already have — as long as you don’t spend that extra money that’s available.

How to Get a Credit Card For a New U.S. Immigrant

Unmasking Online Deception: An In-Depth Social Catfish Review

Purple Garden Psychics – ($1/Min) FREE Trial Offers, Real Experience & Benefits And More

Refinancing an Auto Loan: How to Know If It’s a Good Idea

Reverse Mortgages Pros and Cons: Ripoff or a Good Idea?

8 Ways it Just Got Easier to Achieve Student Loan Forgiveness

Unmasking Online Deception: An In-Depth Social Catfish Review

Orchard Bank Credit Cards | NOT a Scam!

PrivacyGuard Review

How to choose where to study as an international student