FreshBooks Review (November 2022) – Pros, Cons, Features and Pricing

FreshBooks Review (November 2022) – Pros, Cons, Features and Pricing

FreshBooks is an alternative to traditional accounting, built for freelancers, micro businesses and small businesses.

Accounting is an integral part of any business. But that’s not everyone’s strong suit. I found FreshBooks when looking for software that was easy to use and could perform basic accounting functions.

FreshBooks first appeared in cloud accounting as an invoice generator. As the software was expanded, it included double-entry bookkeeping. Plus, you can track time and automatically issue invoice reminders for your customers. Managing your clients, expenses, and projects from one place is another valuable feature, including drafting proposals and financial reports.

Editor’s note: Comparewise has the support of our readers. We may earn commissions when you find products and services through links on our website.

- Make unlimited invoices and send them out to your clients

- Accept payment from 100+ apps including Stripe and PayPal

- Platform has 14 languages and it’s compatible with 170 currencies

History

FreshBooks is a cloud-based accounting program that launched a payment processing component in the fall of 2014. Based in Toronto, Canada, FreshBooks processes payments through a company called WePay. Don’t let Candian HQ put you off – FreshBooks is gaining popularity in the US and can help US-based businesses.

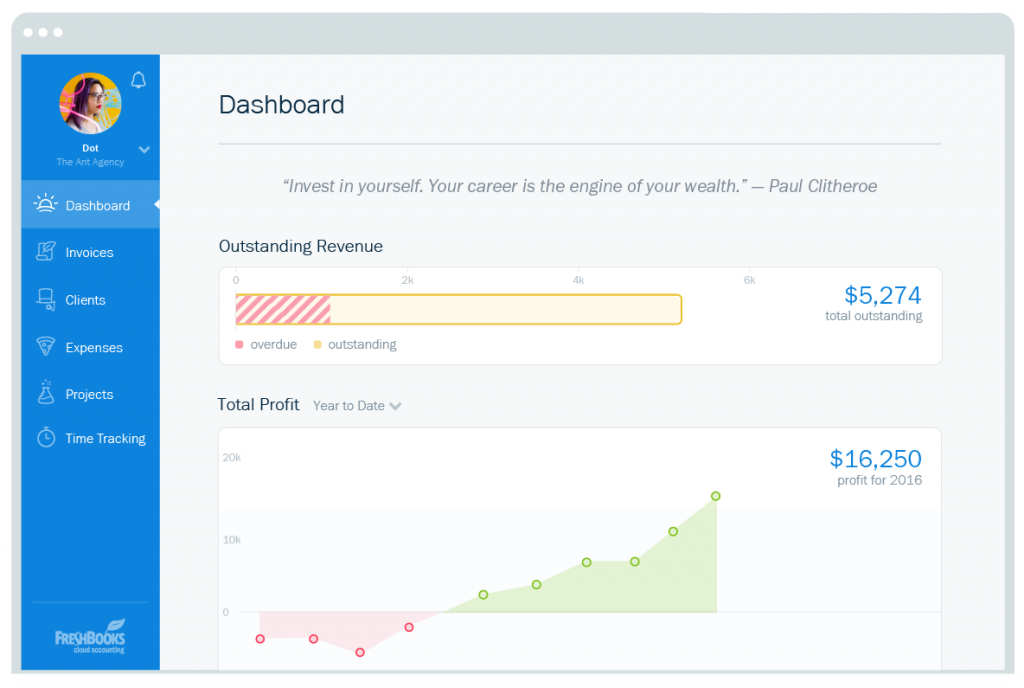

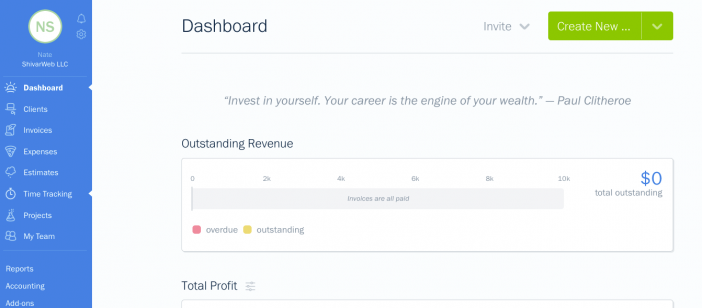

In 2016, the company redesigned many of the interfaces. This is the new Freshbooks dashboard.

Pros of Using FreshBooks

Before I get into the specific things I love about FreshBooks, here are the leading pros that beat all others:

FreshBooks has reduced my time to create, send, file and track invoices and expenses from ~30 minutes per customer to ~5 minutes per customer/partner. If you calculate that time on an hourly rate…that’s a lot of money.

So no matter what bookkeeping platform you use – I would use that rule as the gold standard. Here are my 3 main advantages to FreshBooks.

user friendly

Like many popular web-only software, FreshBooks has a simple, straightforward user-centric design. It is colorful. It has personality.

The new version is more user friendly than the classic version (where my screenshots are from) – but FreshBooks has been user friendly since day one.

It has huge green buttons and a well thought out user interface. It doesn’t have feature overload like desktop-based software.

This is what the main dashboard looks like –

Unlimited invoicing

No matter which plan you go with, you can generate as many invoices as you want and send them to your customers.

Trial access

If you’re not sure about FreshBooks, you can sign up for a 30-day trial and test all features. What’s more, no credit card details are required to sign up.

web based

You don’t need to install any software on your computer to use these features. You can work online from any device, including your phone.

application integration

There are over 100 apps that integrate with FreshBooks, including Stripe and PayPal, for online payments. Additionally, you can sync your customers and orders from Shopify, or use Gusto to automatically import payroll transactions.

Language and Currency Compatibility

The platform is available in one of 14 languages and is compatible with around 170 currencies. The currency feature is ideal when working with international clients.

cost effective

Some free accounting tools are available for small businesses with basic functionality (eg: Wave). However, FreshBooks offers excellent value at a reasonable price compared to most other online accounting solutions.

Other than doing some free trials on competitors (see next steps below), I don’t have comprehensive experience with various bookkeeping platforms. Although I’ve stuck with FreshBooks, I think there are a few things that make FreshBooks no longer for everyone.

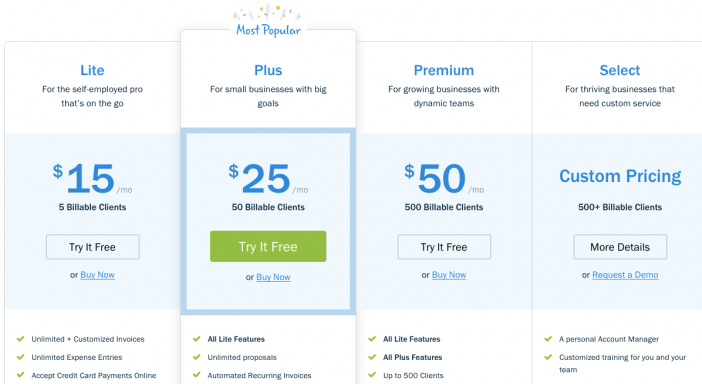

FreshBooks Pricing

I think the biggest downside to FreshBooks is their pricing. Yes, it is reasonable. And I do think it’s worth it.

However, you can technically get features for free or cheaper, and monthly costs can add up quickly over the course of a year.

Side note – FreshBooks actually offers a free invoice creator for one-off projects.

FreshBooks pricing is pretty straightforward – but it depends on one thing – the number of customers you have. If you’re a freelancer or a business that gets projects from many different clients, you’ll quickly get the Plus tier for around $25 per month.

If you’re still in a place you’re building – $25/mo is an attractive cost cut. This is what I do when downsizing a business while working at an agency. I didn’t leave, but I did delete all of my client contacts and left a generic, editable “ad partner” to track my (not client’s) website project earnings. I’ve done the same for a couple of my one-time clients. This puts me at the $15/month level.

That said, $25/month is fine if you work with many well-paying clients. Based on the time saved, this is very reasonable. But if you’re building or working with many clients who use small personal invoicing…FreshBooks’ pricing is a scam.

- Make unlimited invoices and send them out to your clients

- Accept payment from 100+ apps including Stripe and PayPal

- Platform has 14 languages and it’s compatible with 170 currencies

No built-in inventory management tools

There is no integrated inventory management tool in FreshBooks. To track your inventory, you need to integrate with an inventory management application like 2Ship or BarCloud.

Limited users and billing customers

You can only create an account with a single user based on the program’s advertising pricing. To add more users, you must pay $10 per month for each additional user.

Each plan allows you to send an unlimited number of invoices per month. However, there is a limit to how many customers can be billed per month with the Lite and Plus plans. If you have more than 5 to 50 customers, this limit can be a serious inconvenience.

Location restrictions for electronic payments

Only U.S. citizens can use the Automated Clearing House (ACH) online payment method.

No budget, tax or payroll support

FreshBooks doesn’t have tools for paying salaries, creating budgets, or generating tax accounting reports. However, there are many applications that integrate with FreshBooks to perform these functions.

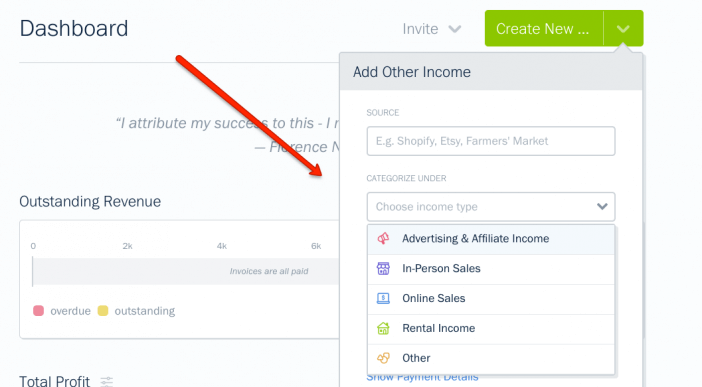

Use other revenue to track ad revenue

Many freelancers earn ad revenue from Google AdSense, affiliate partners, or ad buying. In old FreshBooks everything was set to “client”. To track ad revenue, I created a partner as a client, but used my information.

When I receive payment, I create and save a draft invoice from this partner. Then open the invoice and mark it as fully paid. The income will then show up in your books as if you were invoiced for what you paid – just like a reverse invoicing system.

In the new FreshBooks, I only use the “Other Income” tab.

For now – be sure to keep a copy of the actual generated invoice in case you need to sell or document what is basically a bookkeeping hack – not professional practice.

FreshBooks Review Conclusion

If you’re running a large business, the FreshBooks platform has some limitations. However, for freelancers and small business owners, I still think it’s good value for money.

Compared to other small business accounting software, FreshBooks stands out to me. They give you the tools you need to produce professional financial documents. You’ll also have everything you need to easily manage your income and expenses.

I found FreshBooks very easy to use and I recommend it even if you have no previous accounting or bookkeeping experience. If you’re a one-man band, it will help you simplify specific tasks that are often time consuming.

- Make unlimited invoices and send them out to your clients

- Accept payment from 100+ apps including Stripe and PayPal

- Platform has 14 languages and it’s compatible with 170 currencies

Refinancing an Auto Loan: How to Know If It’s a Good Idea

Reverse Mortgages Pros and Cons: Ripoff or a Good Idea?

8 Ways it Just Got Easier to Achieve Student Loan Forgiveness

15 Smart Strategies for Planning a Move During COVID-19

Term vs. Whole Life Insurance: Why Term is Almost Always Better

PrivacyGuard Review

Orchard Bank Credit Cards | NOT a Scam!

What Is BBY/CBNA On My Credit Report?

What is CitiCards CBNA On My Credit Report