Credit

How to Remove Charge Offs From Your Credit Report

If you have recently pulled your credit report and noticed a charge off, you might be wondering how to remove the charge off from your credit report.

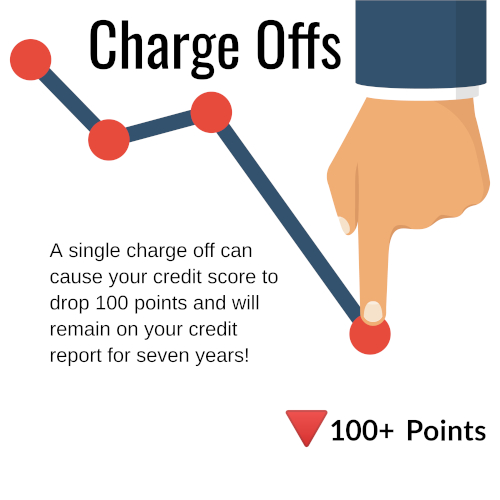

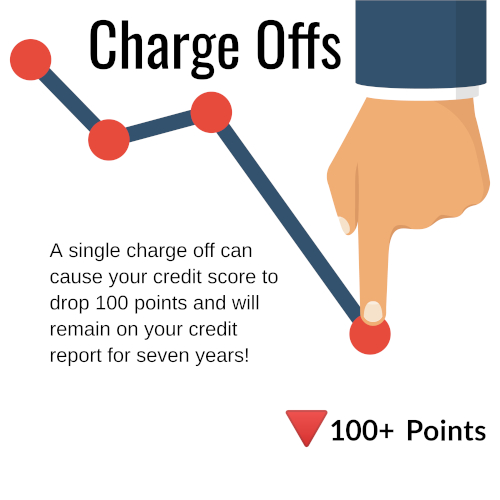

First, know that a charge off in your credit history is a big deal. It will likely cause a huge credit score drop.

It’s important to get charge offs removed. Otherwise, the charge off will stay on your credit report for seven years.

Let’s get into what options you have available.

How Can I Remove a Charge Off From My Credit Report?

Here are 3 proven methods to remove a charge off from your credit report:

- Negotiate A “Pay for Delete” & Pay The Creditor To Delete The Charge Off

- Use The Advanced Method To Dispute The Charge Off

- Have A Professional Remove The Charge Off

1. Offer To Pay The Creditor To Delete The Charge Off

One of the most effective ways to get negative items removed from your credit report is to pay the debt in exchange for the creditor removing the charge off from your credit report.

With this method, you’d use your payment as leverage to convince the debt collector to help restore your credit. But this works only on an unpaid charge off.

If you’ve already paid the charge off but it’s still on your credit report, you really don’t have any leverage to negotiate its removal.

Before You Pay the Charge Off

Before you decide to try this “pay for deletion” route, there are a few things you need to keep in mind.

- If it’s an old charge off, don’t offer to pay the full amount due. Rather, you should try to negotiate for less than what they are asking. Start with 50 percent and go from there.

- Some creditors will claim they can’t legally remove the charge off. This isn’t true. Continue to negotiate until a deal can be made.

- You can negotiate over the phone, but always get the payment arrangement in writing before sending them a check or making an online payment.

- Never give a debt collector access to your bank account.

Ads by Money. We may be compensated when you click on this ad.

Ad

Find a local expert to help remove charge offs Removing a charge off from your credit report can be a lot of work, so you may want to talk to an expert. Click your state to get started. Hawaii Alaska Florida South Carolina Georgia Alabama North Carolina Tennessee RI Rhode Island CT Connecticut MA Massachusetts Maine NH New Hampshire VT Vermont New York NJ New Jersey DE Delaware MD Maryland West Virginia Ohio Michigan Arizona Nevada Utah Colorado New Mexico South Dakota Iowa Indiana Illinois Minnesota Wisconsin Missouri Louisiana Virginia DC Washington DC Idaho California North Dakota Washington Oregon Montana Wyoming Nebraska Kansas Oklahoma Pennsylvania Kentucky Mississippi Arkansas Texas Contact an Expert

Find a local expert to help remove charge offs Removing a charge off from your credit report can be a lot of work, so you may want to talk to an expert. Click your state to get started. Hawaii Alaska Florida South Carolina Georgia Alabama North Carolina Tennessee RI Rhode Island CT Connecticut MA Massachusetts Maine NH New Hampshire VT Vermont New York NJ New Jersey DE Delaware MD Maryland West Virginia Ohio Michigan Arizona Nevada Utah Colorado New Mexico South Dakota Iowa Indiana Illinois Minnesota Wisconsin Missouri Louisiana Virginia DC Washington DC Idaho California North Dakota Washington Oregon Montana Wyoming Nebraska Kansas Oklahoma Pennsylvania Kentucky Mississippi Arkansas Texas Contact an Expert

2. Use The Advanced Method to Dispute the Charge Off

If you don’t have the money to pay the balance in full, or if you can’t get the original creditor to remove the charge off from your credit report, it’s time to dispute the negative entry using a more advanced method.

To dispute the entry you’ll first need a copy of your current credit report. Because of the coronavirus pandemic, you can get a free copy of your credit report each week instead of just once a year.

Visit annualcreditreport.com to get a free credit report from TransUnion, Experian, and Equifax.

When you have your credit reports in hand, find the charge off entry and look at every detail to ensure everything is completely accurate.

The key here is to be very specific. If anything is inaccurate you have the right to dispute the entire entry.

Here are a few details that you should be verifying are accurate:

- Account Number

- Creditor Name

- Open Date

- Charge off Date

- Payment History

- Borrower Names

- Balance

If you find any information that isn’t correct, write a letter to each of the three credit bureaus stating you’ve found incorrect information that needs to be corrected or removed.

You should list the inaccurate information in your letter.

If the credit reporting agencies can’t verify the entry, they’ll have to correct or remove the charge off in compliance with the Fair Credit Reporting Act. Sometimes the information simply can’t be verified and the entry will be removed.

If the charge off is reported accurately, however, disputing it will not help.

3. Have A Professional Remove The Charge-Off

If you’d rather have a professional work on your credit, you might want to read about Lexington Law or we might suggest you visit their website here >>

Credit repair companies can usually get inaccurate and negative items removed a lot quicker than you can on your own. Technically anything they can do is also something you could do yourself, but they are experts and do this all day so talking to them can be really helpful.

But you can get a free consultation to find out how a company can help restore your credit.

Even if you pay several hundred dollars to a credit repair company like Credit Saint, Sky Blue, or Lexington Law, you can save even more by getting lower interest rates and building a more stable personal finance life.

If you have delinquent payments, nonpayments, or charge-offs that are inaccurate, credit repair experts will be able to help.

Ask Lexington Law for Help

Sample Letter To Remove Charge Off From Credit Report

Note: Use this in attempting to negotiate a complete removal or PAID AS AGREED on a debt that states CHARGE OFF or SERIOUSLY PAST DUE on your credit report.

[today’s date]

[original creditor or name of collection agency if the account was sold]

[creditor address]

RE: [account ex: Citibank Mastercard] account # [full account number] (if contacting

a collection agency include the original acc. number, i.e., the Mastercard number in

this case, and also include any acc. number assigned by the collection agency –this

number would be on one of your collection letters)

Dear Sir or Madam,

After recently reviewing my credit report, I took notice that the above-mentioned

account is currently in [status of account, ex: Charge Off] status. I sincerely would

like to take care of this account as soon as possible.

Due to [whatever caused you to be late on your payments, ex: illness], I

unfortunately got behind on my payments and was unable to meet my obligations.

However, since then my situation has greatly improved and I am in the position to

recompense this debt.

I am willing to pay [creditor’s name] [x payments a month] equalling the amount of

[total they are requesting] provided that the above account is updated on all credit

reporting agencies to state: PAID AS AGREED, or completely removed from all credit

reporting agencies upon my final payment.

I am not agreeing to an updated credit report that states this account as: “PAID

CHARGE OFF” or the like, as this will not significantly increase my credit score, nor

will it reflect my sincere willingness to restore my good name and hopefully,

someday, again do business with your company.

Your written response will serve as an agreement to my proposal and I will begin

payments. Thank you very much for your valued time.

Best regards,

[first & last name] [street address] [city, state, zip code]

What Is A Charge Off?

When you haven’t paid on an account for six months to a year, a credit card issuer or other debt collectors will often mark your account as a “charge off.”

This means the creditor has determined it’ll likely never collect your debt. It considers the debt a business loss. The company can write off debt at tax time.

But writing off the debt doesn’t mean the creditor will stop its debt collection efforts.

In fact, the company might even hire a third-party debt collector to handle the collection process. This is important to understand in case you’re contacted by a collection agency you don’t recognize.

Either the collection agency bought the debt from your original creditor and now wants to collect on it — or the agency has been hired by your credit card issuer, lender, or creditor to collect the debt on behalf of the original creditor.

This can happen with credit card debt, unpaid personal loans, or even hospital bills. One or two late payments shouldn’t result in a charge-off, but ongoing delinquency will eventually turn into a charge-off.

How Does a Charge Off Affect Your Credit Score?

Once an account has been charged off, two things will likely happen:

- First, you’re going to start receiving calls and letters from collection agencies attempting to collect the debt.

- Second, the account will be marked as a “charge off” on your credit report.

A charged off account on your credit report will devastate your FICO score. A single charge off can cause your credit score to drop 100 points or more. It’s a big deal.

In addition to your credit score dropping, you’re also going to have a really difficult time getting approved for any new credit cards, mortgages, or auto loans.

Lenders rarely extend credit to people with even one charge off on their credit report.

Paid vs. Unpaid Charge Offs

There are two types of charge offs that could appear on your credit report.

If you have paid the charged-off account in full, the credit bureaus will mark the account as paid; if you haven’t it will remain marked as unpaid.

Will My Credit Score Improve if I Pay the Charge Off in Full?

Some collection agencies may try to convince you paying off the full amount of your charge off will restore your FICO score. This is not true.

A paid charge off will definitely look better to lenders who take the time to do manual underwriting, but it will have a minimal effect on your credit score.

Also, paying off the charge off won’t automatically delete the entry from your credit report. Paying it off will not remove the charge off account, either.

How Long Do Charge Offs Stay on Your Credit Report?

A charge off will remain on your credit report for seven years, and then it’s automatically deleted.

For example, if you stopped making payments on one of your credit cards for six months, and it was marked as a charge off on January 1, 2020, it would remain on your credit report until January 1, 2027.

Even if the statute of limitations on the debt expires after three or five years in your state, your credit report will still show the charge-off, and your credit score will suffer.

Statutes of limitations protect you from legal action but not from bad credit or from phone calls from debt collectors.

Unmasking Online Deception: An In-Depth Social Catfish Review

Purple Garden Psychics – ($1/Min) FREE Trial Offers, Real Experience & Benefits And More

Refinancing an Auto Loan: How to Know If It’s a Good Idea

Reverse Mortgages Pros and Cons: Ripoff or a Good Idea?

8 Ways it Just Got Easier to Achieve Student Loan Forgiveness

Unmasking Online Deception: An In-Depth Social Catfish Review

Orchard Bank Credit Cards | NOT a Scam!

PrivacyGuard Review

How to choose where to study as an international student